Best Black Friday Deals in 2024 | This Year's Best Sales

Black Friday may no longer be a single day, but shopping online for it can be overwhelming. That's especially true when you're looking at Black Friday sales online across a variety of stores. Black Friday offers significant savings, making it crucial to have a shopping plan in place. And we're here to help you make it!

Best Live Black Friday Deals

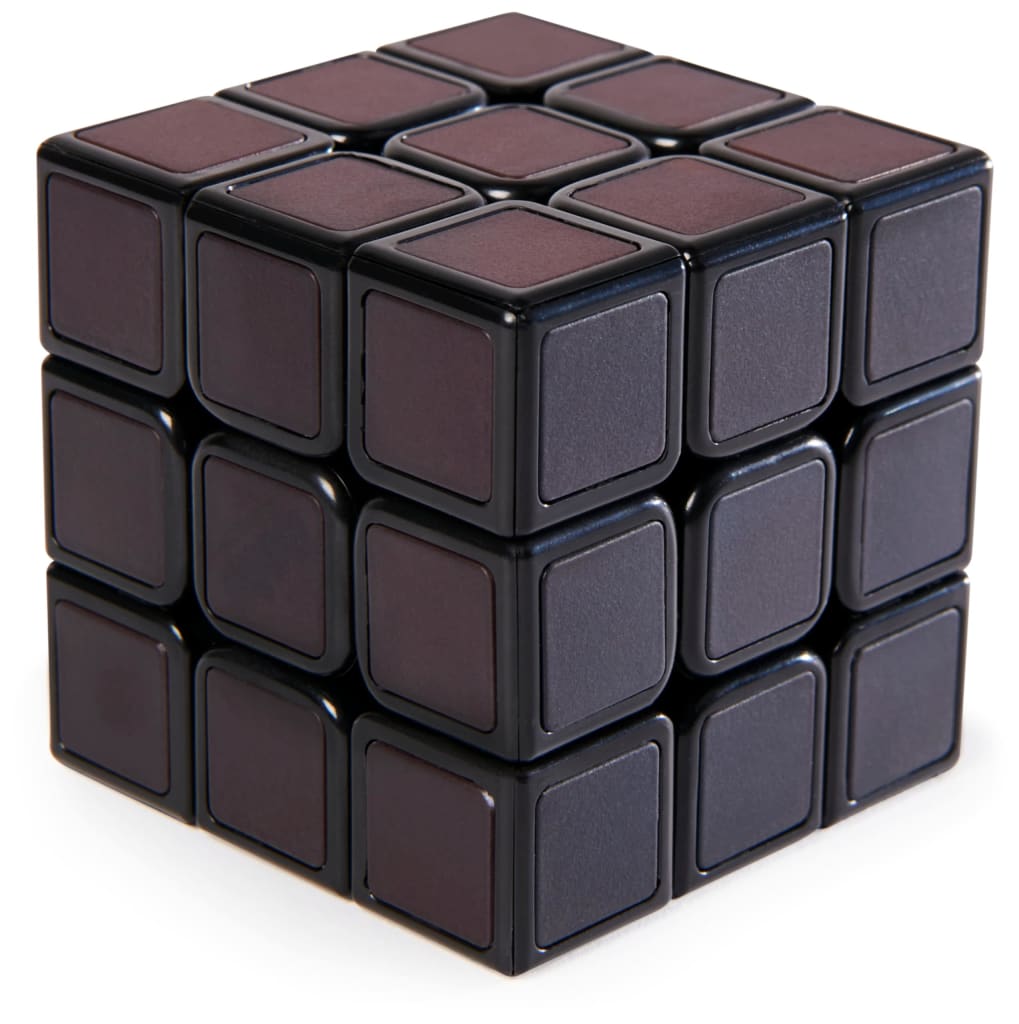

Rubik's Cube Phantom

$5.79That's the best deal we could find by at least $3 and the lowest price we've ever seen.

Hanes Black Friday Deals at Walmart

From $6Shop Black Friday prices on T-shirts, hoodies, underwear, and more. We've pictured the Hanes Men's T-Shirt 12-Pack for $19.98 ($18 off).

Early Black Friday iPad Deals at Best Buy

From $200Bag savings of as much as $1,000 off in total. Plus, be sure to look out for the extra savings for My Best Buy Plus members (it's $50 for an annual subscription.) We've pictured this 9th-Gen. Apple iPad 10.2" 64GB WiFi Tablet (2021) for $199.99 ($130 off.)

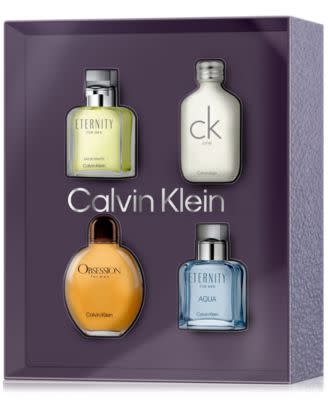

Calvin Klein 4-PIece Eau de Toilette Cologne Gift Set

$25This is one of Macy's Black Friday deals, which originally has an $83 value. Star Rewards members get free shipping on this (it's free to join).

Snap Circuits BRIC: Structures Kit

$19.33Clip the $9.66 coupon to save $35.66 for the best deal we could find by $31.

Anker Qi2 Certified 15W Ultra-Fast MagGo Power Bank

$19.99 w/ PrimePrime members get a discounted price of $29.99, clip the on-page $10 off coupon for the lowest price we've ever seen and a total savings of $50. Note this is only available for the color Pink.

Macy's Black Friday Men's Boots Deals

From $20Men's boots see massive price drops in this Black Friday sale, with discounts of up to 80% applying. Pictured are the Club Room Men's Clifton Lace-Up Moc-Toe Boots, which are $20 ($50 off). Star Rewards members get free shipping over $25 (it's free to join).

FLIR ONE Gen 3 Thermal Imaging Camera for iOS Smartphones w/ Lightning Port

$150That's $50 off and the lowest price it's ever been on Amazon.

The Ridge Wallets and Silicone Rings Black Friday Deals at Best Buy

Wallets from $20, Rings from $50Save on Air Tag wallets, RFID-blocking wallets, silicone rings, and more from this brand. We've pictured the The Ridge Wallet AirTag Money Clip for $20 (low by $3).

Zojirushi 5.5-Cup Micom Rice Cooker & Warmer

$135.64That's a savings of $64 off list, and the lowest price it has ever been.

Best Live Black Friday Sales

Ace Hardware Black Friday Deals: Take up to 60% off select items all month long including brands like DeWalt, Craftsman, and more.

Amazon Black Friday Deals: Amazon's Black Friday deals are now live. You'll find savings and offers on Amazon devices, TVs, small appliances, furniture, apparel, shoes, toys, and more.

Ashley Furniture Black Friday Deals: Save up to $1,000 sitewide in this early Black Friday sale which offers discounts on sectionals, dining room sets, recliners, and more.

Best Buy Black Friday Sale: Skip the waiting and save now on laptops, headphones, small kitchen appliances, TVs, and so much more.

BJ's Wholesale Club Black Friday Deals: Savings include buy one toy and get 50% off a second, up to 50% off tech and TVs, up to 40% off home and kitchen items, up to 25% off furniture, and more.

Bose Black Friday Deals: Get an early jump on Black Friday with these deals from Bose heaphones, speakers, and amplifiers.

Costco Holiday Savings Event: Shop discounts on electronics (including laptops and TVs) plus enjoy savings on other categories like groceries (just in time for the holidays), appliances, and more.

Dell Black Friday Sale: You'll find discounted laptops, monitors, desktops, accessories, and more with laptops starting at just $300 and desktops starting at $600.

GameStop Black Friday Deals: Pick up video games, consoles, and collectibles for less right now! Discounts include up to 50% off video games for select consoles, $25 off pre-owned PS4 and Xbox One consoles, and more.

Gap Factory Early Black Friday Deals: Clearance deals get an extra 55% off in-cart, while most of the rest of the site is marked down up to 70% and gets an extra 15% off in-cart. Shipping starts at $5, but Rewards members get free shipping with orders of $50 or more. (It's free to join, and free shipping applies to your cart total before any extra discounts.)

Home Depot Black Friday Deals: Home Depot was one of the first major stores to go live with its Black Friday deals. You can still shop the store's seasonal best, with big discounts on appliances, tools, grills, and all things home.

Lenovo Black Friday Deal Days Doorbusters: Take up to 75% off with offers including mice from $8, headsets from $12, tablets from $81, and more.

Macy's Black Friday Deals: Save up to 80% off on thousands of items by shopping now including things like up to 70% off suits, up to 50% off boots and shoes, up to 50% off beauty sets, and 20% off select LEGO sets, among others.

Michael Kors Black Friday Preview Deals: These deals are up to 85% off, including sandals from $38, jewelry and wallets from $39, handbags from $59, and much more. Prices are as marked. KorsVIP members bag free shipping, and it's free to sign up.

Nike Early Access Black Friday Sale: Get up to 60% off and an extra 25% off via code "ACCESS" on already-discounted shoes, apparel, and accessories. Nike Members also bag free shipping on orders of $50.

PUMA Black Friday Deals: PUMA has Black Friday deals up to 60% off with kids' clothing starting at $10, men's t-shirts for $10, slide sandals from $11, and shoes from $21. Shipping is free with orders of $60 or more.

Sam's Club Instant Savings: Save up to $2,000 on a variety of products including furniture, appliances, TVs, household essentials, and more.

Samsung Early Black Friday Deals: Shop a variety of deals on phones, smartwatches, Galaxy Buds, and more including up to $1,575 on Galaxy Flip or Fold, up to $1,000 off Galaxy Tab S10, up to $410 off select smartwatches, up to $650 Galaxy S24+, and tons more.

T-Mobile Black Friday Deals: You can get four iPhone 16s w/ lines starting at $25/mo., a Samsung Galaxy S24 w/ an eligible trade-in or new line, and a Pixel Pro 9 w/ eligible plan, amongst other offers.

Target Deal Days Event: Save up to 50% off new deals every day plus ongoing savings like up to 50% off Christmas trees, buy two and get a third free on select board games and toys, and more. Plus, bag free shipping on orders over $35.

Walmart Featured Flash Deals: Shop customer favorites up to 65% off including deals on furniture, TVs, toys, and more. Even better, orders over $35 qualify for free shipping.

Woot Early Black Friday Deals: Woot's early Black Friday deals are now live, featuring savings of up to 55% off home items, laptops, apparel, and more.

UPDATE: The information below was compiled for Black Friday 2024 predictions and sales. Check out the current Black Friday deals for the most up-to-date offers.

Narrowing down your list of where to shop should be one of the first steps you take when creating your plan. Below, we've covered the top seven stores that should have the best early online Black Friday deals in 2024. Check out this guide, then check out all our Black Friday previews for this year.

The 7 Best Stores for Early Black Friday Online Shopping in 2024

What to Expect From Amazon Black Friday Deals

Best for: Prime members with the time and energy to track Amazon Lightning Deals.

Amazon is almost always at or near the top of our list of stores for the best Black Friday online deals. You'll probably find the very best savings among Amazon's Lightning Deals. Many of these offers pop up on a daily basis, though their numbers increase during the Black Friday season. And these deals definitely live up to their name, with new offers starting as frequently as every five minutes. You can track these deals on Amazon's website or through their app, but be ready to jump on them as soon as they go live. Otherwise, you may end up missing out altogether.

Hottest sales: Amazon is pretty competitive when it comes to pricing on bigger items, but it may be hard to beat when it comes to its own devices. For example, Amazon Black Friday deals could include Fire tablets and Fire TV Sticks that both see discounts of up to 50% off. As for Echo devices? Watch for a variety of bundles to be available with savings up to 70% off.

What to Expect From Best Buy Black Friday Deals

Best for: Shoppers searching for Apple or TV deals.

Best Buy is a big go-to for consumers looking for the best electronic deals on Black Friday — and with good reason. The retailer is known for offering tons of savings on TVs as well as the latest gadgets, especially Apple products — a category that doesn't see a lot of discounts in general. (If you're interested in Apple savings, by the way, check out our guide to Apple Black Friday deals.) Black Friday deals for 2024 are expected to start rolling out at Best Buy in October, with a start date for Best Buy's official Black Friday sale slated for November 17.

Hottest sales: In previous years, Best Buy Black Friday deals included smart TVs from just $79.99, as well as up to $900 off select QLED TVs. As for Apple-related deals, the retailer offered up to $1,000 off the iPhone 14 Pro and $600 off select Mac desktops.

What to Expect From Kohl's Black Friday Deals

Best for: Regular Kohl's shoppers.

You might not think of Kohl's when you think of Black Friday shopping, but the retailer has been increasing their offerings for the big holiday over the last several years. Kohl's Black Friday ads have offered numerous pages of savings detailed.

The reason Kohl's deals are so impressive is that many of them come with Kohl's Cash. You could get $15 in Kohl's Cash for every $50 you spend, for instance, and then be able to redeem the coupon if you use it on certain dates. Because of that, these offers are best suited for regular Kohl's shoppers, as they're the most likely to use the Kohl's Cash and thus get the full value of the Black Friday deals.

Hottest sales: Kohl's is a good store to shop for home items, as well as clothing and shoes. Notable offers in previous years featured Toastmaster appliances for up to 80% off; prices were as little as $5 each once shoppers applied a 15% off coupon and submitted a $12 mail-in rebate. Aside from that, the retailer offered 50% off Food Network-brand kitchen and dining items, 65% off ScentWorx products, 50% off Yankee candles and St. Nicholas Square items, 40% to 50% off select furniture, and up to 70% off bedding.

What to Expect From Target Black Friday Deals

Best for: Anyone who walks in to get one thing and leaves with a cartful.

Target's appeal is hard to deny — just perform a Google search for "Target memes" and take in all the images that pop up. The retailer has a wide variety of categories, and reasonable prices make it even easier to add an impulse purchase to your cart. During past Black Friday seasons, Target offered plenty of tempting offers, with their overall ad encompassing numerous pages total. What makes Target even more appealing is its free Target Circle loyalty program and a store credit/debit/reloadable card that provides serious benefits for regular shoppers.

Hottest sales: Expect Target Black Friday deals to include up to 50% off select game accessories; up to 40% off select LEGO sets; 30% off women's sweaters; 50% off select Wondershop pre-lit artificial trees; and 40% off outerwear, cold-weather accessories, and boots for the whole family. The retailer will also likely have another "buy two, get a third free" promotion on all books, movies, and music again this year.

What to Expect From Walmart Black Friday Deals

Best for: Shoppers who are looking for Black Friday deals on a little bit of everything.

Savvy Walmart shoppers are well aware that the store is an excellent 1-stop shop year-round for pretty much anything you can think of, from groceries, to clothing, to toys and everything in between. And when it comes to Black Friday, the retailer continues to shine. Each year it offers up savings on toys and electronics as well as clothing, which makes shopping much easier.

Hottest sales: Walmart is definitely competitive when it comes to Black Friday sales, often undercutting other retailers by just enough to qualify for the best deal. In previous years, the retailer offered plenty of low prices on popular items, such as LEGO sets for just $40 each, select Nintendo games discounted up to 50% off, 65" smart TVs for less than $230, and 70" smart TVs for less than $500.

What to Expect From eBay Black Friday Deals

Best for: People who are interested in refurbished or open-box electronics.

Given that you can find practically anything on eBay, it should come as no surprise that it's one of the best stores for Black Friday online deals. Besides boasting tons of brand-specific discounts, it's a great place to shop for certified refurbished or open-box items. Outlet offers may also be worth looking into during eBay's Black Friday sales.

Hottest sales: One of the key offers to watch for is a coupon that you can use across the site. Historically, eBay has offered 20% off and free shipping via a code. Watch for category-specific sales as well.

What to Expect From Macy's Black Friday Deals

Best for: Shoppers looking for excellent savings on small appliances and home goods.

Macy's used to have a strong brick-and-mortar presence, but in recent years, the company has closed several locations. Even so, the store is still worth shopping online for Black Friday 2024.

Hottest sales: The store is known for its excellent doorbusters, especially small kitchen appliances. In previous years, deals included small appliances for $20 or less, as well as 30% off select Nespresso machines. Macy's also had significant clothing deals, such as 25% off select UGG boots and 50% off dress shirts and ties.

Ready to shop online? Check out the best deals available now, and follow us on Facebook to get the latest deal info and shopping advice. You can also read our other store guides, including ones on Lowe's Black Friday deals in 2024 and lululemon Black Friday deals to learn more about saving at stores during the November shopping holiday.

- Black Friday is on the way and plenty of deals will be popping up, including on streaming services. Here's what to expect this year.

- We'll be maintaining fresh bundle deals throughout 2025. Saving on streaming has never been easier.

- Check out our overview on how to save the most on Peacock TV.

- If you're interested in Paramount Plus but want to save, we have the discount information you need this year.

Sign In or Register