In this section you'll find some of the best limited-time offers that Amazon has available today. Deals are spread across home, electronics, floorcare, and more. Shop Now at Amazon

Men's T-shirts start at $12. Find hoodies from around $28. We've pictured the Carhartt Men's Loose Fit Firm Duck Insulated Flannel-lined Active Jacket from $96 Buy Now at Amazon

Save on a large variety of electronics in the outlet overstock section at Amazon. You'll score deals on video game accessories, keyboards, cables, and much more.

We've pictured the Baofend Handheld Ham Radio 2-Pack for $28 ($27 off). Shop Now at Amazon

Clip the coupon to drop it to the best price that Amazon has charged. Buy Now at Amazon

Save on men's and women's clothing, footwear, sunglasses, beanies, and more. We've pictured the Carhartt Men's Knit Cuffed Beanie for $14 ($6 off). Shop Now at Amazon

Save on select atomic clocks and weather gadgets. You'll need to click into the individual tabs under "Weather" and "Time" to find the deals. Pictured is the La Crosse Technology Equity 2" Gradient Digital Alarm Clock for $17 (low by $1). Shop Now at Amazon

Save on clothing, shoes, and accessories for men, women, and kids. We've pictured the Carhartt Classic Heavy Duty Duffel Bag for Jobsite, Gym and Travel for $56 ($19 off). Shop Now at Amazon

Amazon's Presidents' Day Sale is live. Within, you'll find deals spread across all major categories, including Amazon devices, home essentials, kitchen items, apparel, headphones, TVs, and more. Click here to check out more Amazon offers from this sale and beyond. Shop Now at Amazon

Olumat via Amazon offers the Olumat Keyless Entry Door Lock in Silver or Black for $47.99. 20% off coupon code "PUS6F7UF" plus a 20% Prime discount make for a final price $47.99. Shop Now at Amazon

- Wi-Fi and app enabled

- Biometric fingerprint access

- Multiple entry forms; keys, codes, fobs

- One-time pin code option

- Easy to install with just a screwdriver

- Compatible with most American front doors

Save on furniture, portable air conditioners, and more. We've pictured the HomCom Bar Height Bar Stools Set of 2 for $123.62 (low by $30). Shop Now at Amazon

If you've been thinking about adding a thermal imager to your DIY kit (or you just want to hunt down drafts, insulation gaps, and hot electrical spots), Amazon has a bunch of thermal imaging cameras on sale right now, with prices starting at $95. We've pictured the HF96 Thermal Camera with Laser Pointer and Intelligent Scene Detection for $165 ($55 off). Shop Now at Amazon

Shop deals on Leviton light switches, dimmer switches, and outlets. We've pictured the Leviton T5832-W Type-A USB in-Wall Charger with 20A Tamper-Resistant Outlet for $18 ($9 off). Shop Now at Amazon

Clip the on-page coupon to get this price. Buy Now at Amazon

Shop T-shirts, hoodies, caps, and more representing Elvis, Led Zeppelin, Metallica, Grateful Dead, Green Day, and many others. We've pictured the Liquid Blue Men's Grateful Dead-Montego Bay T-Shirt for $19 ($5 off). Shop Now at Amazon

It's the best price that Amazon has charged for this table and a low now by $46. Buy Now at Amazon

It's the best price we could find by $7. Buy Now at Amazon

It's the best price that Amazon has charged for this parking mat. Buy Now at Amazon

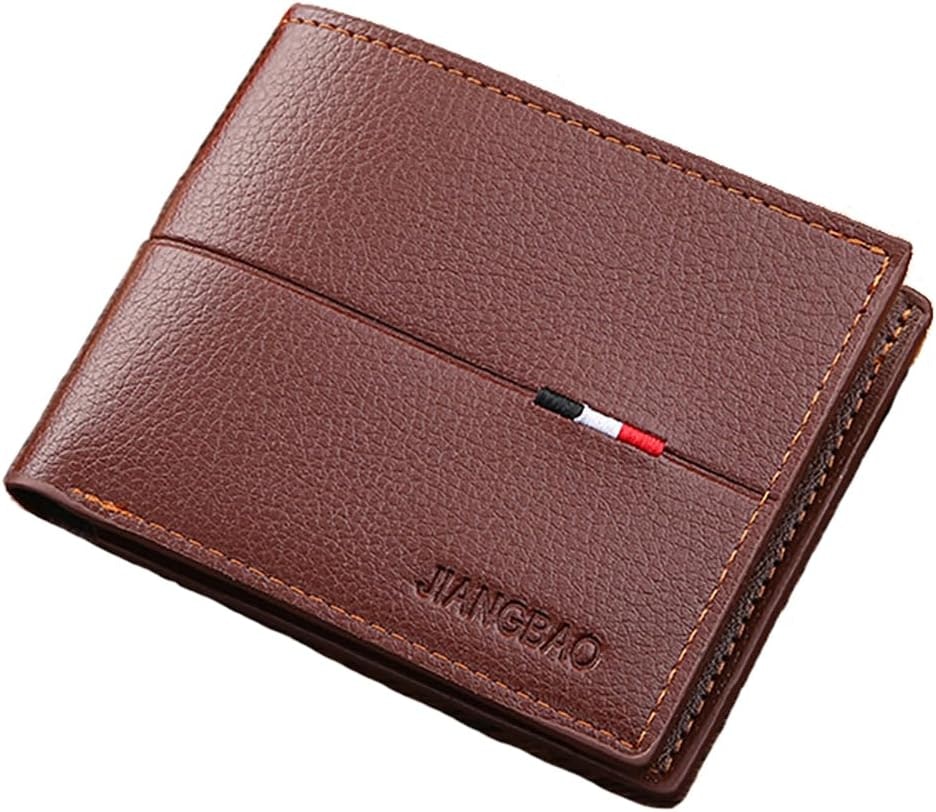

It's a great price for such a wallet. In Brown 3 or Brown Z styles. Buy Now at Amazon

Cyber Monday Special! Enjoy discounts of up to 50% off and save big on Magicshine bike front lights and taillights. Save on the new HORI 900LM/1300LM dual-mount front light and the new SEEMEE 150MAG magnetic taillight. They're suitable for safe night riding as well as being weatherproof and high-lumen. Shop Now at Amazon

How to Shop and Save at Amazon with Coupon Codes

Amazon dominates the world of online shopping. The massive retailer started by selling only books, but is now known for offering nearly everything with rapid-fire shipping to your doorstep via Amazon Prime.

Along with endless product selection at competitive prices, Amazon has a huge amount of coupons and special promotions that even seasoned shoppers may find hard to keep up with. To help cut through it all, we’ve compiled a list of ways to locate these extra discounts along with additional shopping tips and resources.

Special Discounts and Promotions

Amazon has an extensive selection of coupons and promotions available at any given time. With their complex website and huge network of third-party sellers (which may provide their own discounts), locating all of these offers isn’t always straightforward.

General discounts that apply to anything across the site shouldn’t be expected. Most are specific to certain products, categories, or sellers. Saving money at Amazon has everything to do with flexibility; for instance, being in the market for a certain item type but open to the exact brand or product.

That said, Amazon does offer occasional general discounts in exchange for first-time actions such as signing up for the app, adding an Amazon Cash credit, reloading an Amazon gift card, or certain gift card purchases.

Amazon Coupons

There are two types of coupons available at Amazon: clip coupons and coupon codes. Amazon maintains a page with all available clip coupons that you can search or browse by category, such as grocery coupons . These coupons also display under the price on product pages and in the cart. Like a code, they require action by the customer in order to get the discount.

It’s simply a matter of clicking on it to activate it, but you won’t see the discount or any mention of it at checkout if you don’t. And like Amazon’s constantly changing prices, clip coupons can come and go quickly.

Promo codes may also display on the product page. Scroll down to the “Special offers and product promotions” section to see if anything is available, but keep in mind that not all available codes will be found this way.

DealNews tracks an extensive list of Amazon discount codes, many of which are unadvertised and provide significant savings. For instance, as of this writing, a deal for a pair of Bluetooth headphones has a $10 clip coupon and a code not listed on Amazon for another $20 off, which combine for a $30 total savings.

Speaking of combining, Amazon does not limit how many codes you can enter. You can stack multiple coupon codes and clip coupons to get the maximum savings. Amazon will apply the discounts for anything eligible in your order. Here we have more information on how to find Amazon coupons .

Daily Deals

The Today’s Deals page on Amazon compiles the Deal of the Day and Lightning Deals, which are available in limited quantities for a short period of time. More savings, coupons, and sales are listed here as well, so you can find various discount options in one place.

Email Alerts

One way to keep up with many current promotions is subscribing to Amazon emails for coupons or Daily Deals. These options are located under the Deals section and will notify you of special offers in your inbox.

Subscription Discount

Amazon’s Subscribe & Save program provides a discount and free shipping on automatic deliveries of products that are frequently replenished. The standard discount is 5%, but it can go up to 20% for subscriptions of five or more items.

Additionally, there are Subscribe & Save coupons that give an extra discount of up to 40% or more off the first order of eligible products. Clip the coupon and select Subscribe & Save on the product page to get the savings, which stack with the standard subscriber discount. You can skip months or cancel at any time.

Refurbished, Used, and Overstock Products

You can save on pre-owned items, refurbs, or overstocks by checking out these pages at Amazon:

- Amazon Warehouse : Shop for used and open box products, including closeouts in the Bargain Bin that are last-chance items at up to 50% off or more.

- Amazon Outlet : Find thousands of overstock items at a discount.

- Amazon Renewed : Get savings on refurbished products that have been inspected and tested to work and look new and come with an Amazon Renewed Guarantee. Save even more by using Renewed Coupons . You can shop pre-owned and open-box items from here as well.

Trade-In Credit

With the Amazon Trade-In program, you can trade in electronics, video games, and more items for an Amazon gift card. Special offers may be available that include an extra discount on a new item purchase with the trade. Amazon gives an immediate offer and provides free shipping to send the item in. If a device doesn’t qualify, recycling is offered at no cost and also includes free shipping.

Additional Savings

Here are more pages you can peruse on Amazon to find discounts:

- Amazon Move : The Amazon Move Discount can be applied for multiple orders for 10% off purchases up to $200 ($20 maximum discount).

- Amazon Device Deals : Find current offers on Echo and Alexa devices, Fire tablets, Fire TV, and other products

- Free Kindle eBooks : A wide selection of tiles are available at no cost

- Shop with Points : Apply points from a variety of popular credit card and hotel rewards programs to your Amazon purchase

- Amazon Fashion Sales and Deals : Save on clothing, shoes, and accessories

- Beauty Sales and Deals : View sales and coupons for skin care, men’s grooming, and more personal care items

- Free Android Apps and Games : Choose from thousands of options for your Fire tablet or device

- Prime Book Box : Sign up for this subscription to receive children’s books (2 hardcovers or 4 board books) every one to three months at up to 40% off the list price

Membership Program

Amazon Prime famously offers members fast, free shipping benefits , such as free one- or two-day shipping on eligible items or even quicker in select ZIP codes. Other Prime perks are numerous and include some that even frequent Amazon shoppers may not be aware of.

Many of the popular benefits are digital: a wide selection of free TV shows and movies to stream on Prime Video , free songs to listen to on Prime Music , and free Kindle eBooks in Prime Reading . You’ll also find a plethora of product discounts all over the site that are exclusively for members (look for prices that say “Prime Deal”) or members get early access to savings in the case of Lightning Deals . A wide selection of Prime-exclusive coupons are available as well.

The cost of Amazon Prime is $139 per year or $14.99 per month. While the annual plan is cheaper on a per month basis for shoppers that use the service year-round, the monthly plan is flexible and allows for only joining at times it’s needed the most.

Students, EBT, and Medicaid customers get a 50% discount on Prime membership . Additional ways to save, such as setting up a household under one plan, are covered in our guide on how to get deals on Prime .

Education Pricing

Amazon offers college students a free six-month trial of Prime Student and $6.49 per month or $59 per year after, which is half the standard cost of Prime. In addition, exclusive student discounts are available and textbooks can purchased at up to 90% off. After April 1, 2023 Amazon no longer offers textbook rentals.

Military Discount

Amazon does not offer a standard, ongoing military discount. However, we’ve previously seen a discount on Amazon Prime plans offered to military customers for Veteran’s Day, so be sure to check around military holidays or days of observance for special offers.

Government Discount

Customers that are recipients of government assistance programs can get a discount on Amazon Prime. This applies to EBT or Medicaid cardholders. After a 30-day free trial, the plan is $5.99 per month. This saves $6 per month off the standard monthly price of Prime, which is just over 50% off.

Trade Professional Discount

Amazon Business provides resources and purchasing solutions for enterprise, small business, government, nonprofit, healthcare, and education. Amazon Business Prime plans start at $69 per year for one user and go up to $499 per year for up to 10 users. These plans include free Prime shipping, member-only offers, and customer feedback through Delighted. Options are available for spending analytics, guided buying, and extended payment terms by invoice.

Members can apply for the Amazon Business Prime American Express Card to get 5% back on Amazon or 90-day interest-free financing.

Card & Credit Options

Amazon offers the following consumer credit cards:

- Amazon Rewards Visa Signature Card 3% back at Amazon.com and Whole Foods Market, 1% to 2% back elsewhere, and a gift card upon approval

- Amazon Prime Rewards Visa Signature Card 5% back at Amazon.com and Whole Foods Market for Prime members, 1% to 2% back elsewhere, and a gift card upon approval

- Amazon Prime Store Card 5% back or special financing at Amazon.com for Prime members and a gift card upon approval

Free Shipping

Any Amazon customer can get free shipping on eligible orders. This applies to 5-8 day shipping on items sold or fulfilled by Amazon. The product page will display messaging that the item qualifies, but be sure to select the free shipping option at checkout. Our full guide on Amazon free shipping without Prime has even more details.

If you do have Prime, you’ll get free two-day or one-day shipping as a part of the membership, plus several other Prime shipping benefits depending on location and speed. Like the free shipping you can get without Prime, it applies to items sold or fulfilled by Amazon. Check for the Prime logo next to the price on product pages to see if an item is eligible.

Don’t need it so fast? Opt for free no-rush shipping where available in exchange for rewards and discounts, typically credits on digital downloads.

Whether you have Prime or not, buying from a third-party seller that fulfills its own orders (meaning they handle and ship their own inventory) means paying their shipping rates. It may still be free in some cases or there may be a charge. On the product page, you won’t see the Prime logo and the shipping rate will be next to the price.

For all shipping options, the times apply to how long the item takes to actually ship, but does not include processing time for preparing and packing the order.

Major Sales

Prime Day is one of Amazon’s biggest sales of the year. It’s a member-only sales event that has traditionally been held during July for up to 2 days. For Amazon Prime Day 2025, they're upping the game and increasing the event to run for four days from July 8 through July 11. There are tons of deals available for Prime members across the site, often in the form of Lightning Deals that last for a limited time or until stock runs out. For the first time in October 2023, Amazon also held a Prime Early Access Sale in advance of Black Friday.

Additionally, there are promotions on a variety of Amazon services, particularly for first-time users. Some of these offers will start a little early, so keep an eye out for what comes up around two weeks prior to the start of the sale.

Amazon has big sales for Black Friday and Cyber Monday as well. Amazon issues a press release one to two weeks before Black Friday to provide information on the deals that will be available. It is usually quite vague, meaning the exact items or start times aren't always revealed and it only includes a small selection of what’s actually going to be on sale.

Deals are available throughout the month of November, but really ramp up the week of Black Friday and run through Cyber Monday. The most compelling deals will be limited-time offers that pop up on Thanksgiving, Black Friday, or Cyber Monday only.

Price Match Policy

Amazon does not offer price matching , but we find that the pricing they offer often matches or beats major competitors automatically. That said, Amazon won’t be the lowest price in every case.

It’s a good idea to price check other stores and review the Amazon price history at sites like CamelCamelCamel before purchasing. If your item is listed as a deal on DealNews, we’ve already done the price checks to ensure it’s the lowest price available.

Price Adjustment Policy

Amazon offers a Pre-Order Price Guarantee that applies to select products not yet released. If you order in advance and the price changes before the end of the release day, you’ll be charged the lower price once the item ships.

Amazon doesn’t state that any other types of price adjustments are available, so they won’t offer a partial refund if a price drops on their website after you purchase.

Return & Exchange Policy

The Amazon Return Policy states that most items (with these exceptions ) can be returned within 30 days of receiving the shipment. Amazon will also make exchanges for a different size or color on certain items without the need to create a new order. (The original item must be returned in 30 days to avoid being charged for both.)

Returns are made by going to your Order History and selecting “Return or replace items” next to the item you want to send back. You will see different return options based on the product, reason, or seller. Follow the steps until you receive a confirmation and a return label or QR code, depending on the return option being used. There are various return methods , some of which are drop-offs and don’t require a box or return label.

Local Store Locator

Amazon is known for selling online, but they also operate physical stores in some states. You can find your nearest location of Amazon Books, Amazon 4-Star, Amazon Go, or Amazon Pop Up stores. Amazon owns Whole Foods Market locations as well and offers Prime-exclusive savings in these stores, such as an extra 10% off items with yellow sale signs and weekly deals.

Contact & Customer Service Information

The Amazon Help Center offers answers to common questions across a multitude of topics. If you need to contact Amazon , the primary way is chat. The chat bot can either help with the issue or connect you to the right place for assistance. The Amazon phone number is 1-888-280-4331 .

Frequently Asked Questions

Where do you enter an Amazon promo code?

Before applying a discount code, check to see if your item has a clip coupon available. A clip coupon will show on the product page and in the cart under the item price, but it won’t show once you proceed to checkout. To activate a clip coupon, you simply click on it. You will see the discount show at checkout and you can combine it with a coupon code if you have one.

To apply a promo code, add your item to the cart and proceed to checkout. In the “Payment method” section, there is a box that says “Enter code”. This is for entering a gift card or promotional code. Enter the code and select “Apply”. You will see the discount apply or get an error message that the code is not valid, which either means it expired or doesn’t apply to the item in the cart.

I have more questions. Where can I get additional information?

See our full Amazon Q and A feature for answers to many more frequently asked questions as well as our extensive list of Amazon shopping guides .

Sarah Jones is the resident coupon expert at DealNews and oversees a team that covers deals, coupons, and Black Friday content. Her articles or quotes have been featured on sites such as Christian Science Monitor, Oprah.com, Fox Business, Kiplinger, and Lifehacker.