There's a lot on offer here, of which we've pictured this Sweetcrispy Mid-Century Modern Accent Chair for $109.99 ($590 off.) Shop Now at Target

Shop key cap packs from $3.49, mice from $9.99, component cables from $6.48, plus printers, laptops, ink, and more. We've pictured the Monoprice Wireless Membrane Keyboard and Optical Mouse Combo for $33.41 ($24 off). Buy Now at Target

You'll find savings on iPads, iPhones, AirPods, and accessories for Apple devices in this new Target sale. Opt for store pickup (where available) to dodge the $5.99 shipping fee or orders of $35 or more ships for free.

This deal was good enough to make our roundup of the top five best deals of the day. Follow that link to see our latest selection. Shop Now at Target

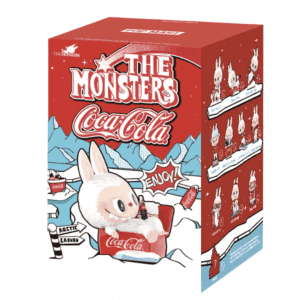

If you fully understand what a Labubu is, a) you're already ahead of us, and b) you'll probably be excited to know you can buy them at Target, with prices starting from $38.99. But maybe the real Labubus were inside us all along. (But in another sense, the real Labubus are the ones on sale at Target, and shouldn't be taken internally.) Buy Now at Target

Target's Clearance Event has gone live with discounts of up to 50% on clothing, toys, shoes, and beauty and personal care items. Shipping is free over $35. Shop Now at Target

There are hundred of deals on games for Nintendo, PlayStation, Xbox and more. We've pictured Mario & Sonic at the Olympic Games: Tokyo 2020 for Nintendo Switch for $29.99 (half off.) Orders of $35 or more ships for free. Buy Now at Target

Target's Deal Days event went live last week and the store has been adding new offers to the pile each day. There are two to three new deals or sales every day in the daily deal section, as well as ongoing discounts like up to 50% off Christmas trees, a buy two, get one free offer on board games and toys, and more. Shipping is free over $35. Shop Now at Target

Target has a huge selection of tablets, smart home devices, headphones, cell phones, gadgets, and more. Some of the big brands included are Samsung, Beats, HP, Ring, LG and more. Orders of $35 or more ships for free. Shop Now at Target

Get into the holiday spirit by shopping early for outdoor Christmas decorations at Target, with the biggest discounts on clearance items from previous season. Shipping is free with $35 and many items may qualify for in-store pickup. Shop Now at Target

If you want to jump into Spotify Premium but don't want to worry about monthly payments, this gift card is an excellent solution! For just $99 you'll get 12 months to explore everything Spotify Premium has to offer, including ad-free listening to music and podcasts as well as access to the audiobook subscriber catalog and more. Even better, by opting for the gift card, you'll actually save $44 compared to paying for a year at the monthly rate. Note that once the year is up, your account will be charged the the-current monthly rate to continue, so be sure to cancel beforehand if you need to. Buy Now at Target

Save on a half dozen models, each in multiple colors. We've pictured the Apple Watch Series 10 46mm GPS Smartwatch (2024) for $360 ($70 off). Shop Now at Target

You've one more day to save on Black Friday prices on smartphones at Target. Deals include new and refurb models, including brands like Samsung, Motorola, BLU, and Google Pixel. Shop Now at Target

New colors include Mauve Shimmer, Glazed Donut, Aster, Cherry Mocha, Blueberry Milk (pictured), and Pearl. Shop Now at Target

We've picked out this Costway Mid Century Retro Rocking Chair for $155.99 ($294 off.) Shop Now at Target

A selection of Target Black Friday deals are already live at Target, including a video game sale where titles are discounted by up to 60%. You can also save up to 50% off on headphones, up to $150 on Apple devices, and up to $150 on the Oura Ring 4. Orders over $35 ship for free, too.

Target price protection is now live, too, so if you purchase an item in store or online and the price goes lower at Target on or before December 24, you can request a price adjustment. Proof of purchase is required and some exclusions apply. Shop Now at Target

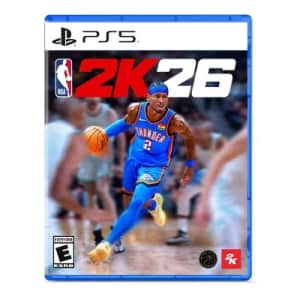

Save on games for Nintendo, Xbox, Playstation, and more. We've pictured NBA 2K26 for PS5 for $30 ($29 off). Orders of $35 or more ships for free. Shop Now at Target

Save on over 70 sets. Pictured is the LEGO Harry Potter Hogwarts Castle Boathouse for $30 (low by $8). Shipping adds $6.99, but orders of $35 or more qualify for free shipping. (Pickup may also be available, depending on ZIP.) Shop Now at Target

There are over 25,000 items included here, so shop by category. Shop cookware from $9, kitchen storage from $2, glassware from $2 and a lot more. We've pictured this Cuisinart Air Fryer Toaster Oven for $99.99 ($130 off.) Shop Now at Target

Save on garden tools, patio furniture, bug spray, and more. Shop Now at Target

Stretch your dollar further on your next takeout order by picking up discounted Grubhub gift cards in 2025 at Target. They're available in $25, $50, $75, or $100 amounts and be purchased as digital or physical cards. Even better, if you're a Target Circle Cardholder - including credit, debit, or reloadable cards - you'll earn 5% back on your gift card purchase. Shop Now at Target

It’s a phenomenon so common it has its own name: the Target Run. You walk in with a simple mission, maybe to grab milk and paper towels, but you emerge an hour later with a cart full of things you didn’t know you needed but absolutely love. From stylish home decor and exclusive designer collaborations to a surprisingly robust grocery section, Target has perfected the art of being a one-stop shop that feels more like a discovery zone than a big-box store. It’s the home of "affordable joy," where you can stock up on essentials while also treating yourself to something special, all without breaking the bank.

With so many products, promotions, and Target coupon codes floating around, figuring out how to get the absolute best price can feel like a puzzle. This has become even more true following the recent overhaul of their loyalty program, which consolidated everything under the new Target Circle umbrella. Now offering three distinct tiers—a free version, the powerful Target Circle Card, and a new paid subscription called Target Circle 360—the opportunities to save are bigger than ever, but it can also be a little confusing to navigate.

That’s where we come in. Consider this your ultimate guide to mastering every savings angle the retailer has to offer. At DealNews, our expert team is obsessed with finding the best ways to save, and we’ve broken down everything you need to know about Target’s programs, policies, and insider tricks. Read on to make sure your next Target run is your most affordable one yet.

How to Save the Most at Target in 2025

Target's bright aisles are practically designed to encourage spending, but with a little strategy, you can turn every trip into a savings victory. The secret is knowing how to leverage the store's powerful loyalty programs and stack multiple discounts on a single purchase. It might seem complicated at first, but once you know the rules, the deals are everywhere. Let's break down every tool at your disposal to save the most on your next Target run.

Master the Art of Coupon Stacking

Target has a famously generous coupon policy that allows savvy shoppers to stack multiple discounts on one item. For a single product, you can typically combine one manufacturer coupon (either paper or digital), one Target store coupon (found in the weekly ad, for example), and one Target Circle percentage-off offer. After all those discounts are applied, you can then pay with your Target Circle Card to get your final 5% off.

Use the Price Match Guarantee

Don't assume the price on the shelf is the lowest you can get. Target will price match identical items from its own website (Target.com) as well as from major competitors like Amazon, Walmart, Best Buy, and others. If you find a lower price at a qualifying retailer, just show the proof to an employee at checkout or Guest Services. The policy even extends for up to 14 days after your purchase, so it pays to keep an eye on prices even after you've bought something.

Shop the Weekly Ad and Know the Markdown Schedule

The Target weekly ad, which runs from Sunday to Saturday, is your roadmap to the best sales of the week. You can find it in the app, online, or in your local newspaper. For even deeper savings, try to learn your local store’s unofficial markdown schedule. While it’s not a formal policy, many stores mark down specific departments on certain days of the week, such as electronics on Monday, pet supplies on Tuesday, and sporting goods on Thursday. A quick, polite chat with a team member might give you the inside scoop.

Snag a Gift Card With Purchase

One of Target’s most popular promotions is its "gift card with purchase" deal. These offers are extremely common for categories like household essentials, beauty products, and baby care. For example, you might see an offer to "Buy 3 select laundry detergents, get a $10 Target GiftCard." This is essentially free money for a future shopping trip just for stocking up on items you were going to buy anyway.

Take Advantage of Special Group Discounts

Target frequently offers special discounts to specific groups throughout the year. Typically, you’ll need to verify your status through Target’s website to get the coupon. Keep an eye out for these annual events:

- Teacher Discount: During the summer Teacher Prep Event, K-12 teachers, professors, and homeschool teachers can get a one-time discount (usually 15-20%) on school supplies and other classroom items.

- Student Discount: Verified college students can often grab a similar one-time discount on dorm essentials and more during the back-to-school season.

- Military Discount: Around the Fourth of July and Veterans Day, Target typically offers a 10% discount to active-duty military personnel, veterans, and their families.

These group-specific offers are a fantastic perk, but they require a little bit of planning. Since they pop up during specific times of the year, like the back-to-school season or national holidays, it’s a smart move to verify your status on Target’s website ahead of time. That way, you’re all set to grab your exclusive coupon the moment the promotion begins.

Join Target Circle for Free

This is the absolute first step for any Target shopper. Target Circle is the store’s free loyalty program, and it’s a no-brainer to join. Simply by signing up with your name and email, you get access to a constant stream of digital coupons and automatic deals that are applied when you scan your app barcode or enter your phone number at checkout. Members also get a special 5% off coupon during their birthday month. There's no cost and no reason not to sign up.

Get a Target Circle Card for an Instant 5% Off

This is the big one. The Target Circle Card (formerly known as the REDcard) is arguably the best store card on the market. It comes in three versions—a credit card, a debit card that links to your existing checking account, and a reloadable account—all with no annual fee. Its signature perk is a flat 5% discount on nearly every single purchase you make at Target, in-store or online. This isn't a rewards program where you accumulate points; it's an instant discount that comes right off your total at checkout. Better yet, this 5% discount stacks with sales, clearance prices, and other Target Circle offers. Cardholders also get free two-day shipping on Target.com with no minimum spend and an extra 30 days to make returns.

Upgrade to Target Circle 360 for Ultimate Convenience

For the true Target devotee, Target Circle 360 is a paid subscription service built for maximum convenience. For an annual fee, members get unlimited free same-day delivery for orders over $35, powered by Shipt. This service can have your order at your doorstep in as little as one hour. While the standard annual price is $99, Target Circle Card holders get a massive discount, bringing the cost down to just $49 per year. If you frequently use same-day delivery, this is an incredible value.

Hunt for Red Clearance Stickers

Target’s clearance sections are a treasure trove for deal seekers. You’ll typically find clearance items on the endcaps of aisles, marked with a red sticker. These stickers will often show the percentage of the markdown in the top right corner, starting at 15% or 30% and eventually dropping to 50% and even 70% off. Keep an eye out, as new items are moved to clearance every week.

Score a 15% Registry Completion Discount

If you're creating a registry for a wedding, baby, or college, do it at Target. After your event date, the store will send you a coupon for 15% off everything that’s left on your registry. It’s the perfect opportunity to buy any remaining big-ticket items for yourself at a significant discount.

Trade In Your Old Car Seat

Twice a year, Target hosts its much-loved car seat trade-in event. During this period, you can bring in any old, expired, or damaged car seat—regardless of brand or condition—and in return, you’ll receive a 20% off coupon valid on a new car seat, stroller, or select baby gear.

Choose In-Store Pickup or Drive Up

If you’re placing an online order that doesn’t meet the $35 free shipping minimum (and you don’t have a Circle Card), you can still avoid shipping fees by choosing a free pickup option. Target’s Order Pickup lets you grab your items at the Guest Services desk, while the ultra-convenient Drive Up service lets you stay in your car while a team member brings your order right out to you.

Bring Your Own Reusable Bag

It may be the smallest discount on this list, but it’s also the easiest. Target gives you a $0.05 discount for every reusable bag you use at checkout. It’s a nice little bonus for being green, and for a true deal seeker, every penny counts.

This Year’s Pricing and Options

Target has always occupied a sweet spot in the retail world. While it may not always have the absolute rock-bottom prices of a super-discounter like Walmart, its famous slogan—"Expect More. Pay Less."—perfectly captures its strategy. Target’s base prices on national brands are competitive, but the real value often shines through in its high-quality owned brands like Good and Gather for groceries and Cat and Jack for kids' apparel. The key for any shopper is to remember that the sticker price is just the starting point. The final price you pay is almost always lower once you factor in the store's powerful, layered discounts.

A Closer Look at Target's Membership Plans

In early 2024, Target streamlined its various loyalty offerings into a cohesive, three-tiered system under the "Target Circle" brand. This move makes it easier for shoppers to understand what they get at each level and how the benefits build on each other.

The basic Target Circle membership is completely free and is the absolute minimum every shopper should have. It unlocks access to thousands of digital deals and coupons in the Target app, which are automatically applied at checkout when you scan your Wallet barcode or enter your phone number. You also get a 5% off coupon during your birthday month and the chance to vote in Target’s community giving initiatives.

The Target Circle Card is the next step up and the single most powerful savings tool available. Whether you choose the debit, credit, or reloadable version, the benefits are the same: an instant 5% discount on your total purchase, free two-day shipping from Target.com with no order minimum, and an extra 30 days for returns. For anyone who shops at Target more than a couple of times a year, the card pays for itself almost immediately.

At the top is Target Circle 360, the paid subscription tier. Its primary benefit is unlimited free same-day delivery through Shipt on all orders over $35. For shoppers who love the convenience of having groceries, essentials, and last-minute gifts brought to their door, this program can offer huge savings over the per-delivery fee. The value is especially strong for Target Circle Card holders, who can get the annual membership for just $49.

Target Pricing in Previous Years

Target's pricing strategy has always been a masterclass in value perception. For decades, the "Expect More. Pay Less." philosophy has guided their approach, signaling to customers that they don't have to sacrifice quality or a pleasant shopping experience for a good deal. Unlike pure price leaders who compete solely on being the cheapest, Target has historically focused on offering a better overall value proposition.

A key part of this strategy has been the aggressive development of high-quality owned brands. Lines like Good and Gather in groceries, Cat and Jack in kids' apparel, and Threshold in home goods have allowed Target to control both quality and cost. This gives them exclusive products that can't be found anywhere else, priced competitively against national brands. In previous years, while you might have found a box of name-brand cereal for a few cents less at a competitor, you'd find Target's stylish and durable in-house alternative for significantly less, creating a powerful incentive for shoppers to stick with the Bullseye. This focus on premium-feeling private labels at a sharp price point continues to be the foundation of their pricing model today.

How to Shop at Target

Gone are the days when a Target run exclusively meant pushing a red cart through the physical aisles. Today, Target offers a full suite of shopping options designed to fit your schedule, whether you have an hour to browse or just two minutes to tap out an order from your phone. Understanding each method can help you choose the most convenient and cost-effective way to get your stuff.

- Shopping In-Store: The classic and still beloved "Target Run." This is the best way to discover new items, browse the Bullseye's Playground dollar section, and get a hands-on feel for products. It’s also the only way to get a Starbucks drink while you shop.

- Ordering on the Target App or Website: This is the central hub for all of Target's digital services. You can shop the entire inventory, manage your Target Circle deals, and choose any of the fulfillment options below.

- Drive Up for Curbside Pickup: This is arguably Target's most popular service. Simply place your order through the Target app, and the store will notify you when it's ready. Pull into a designated Drive Up spot, tap "I'm here" in the app, and a team member will bring your order right out to your car, no contact required. You can even add a Starbucks order to your pickup at the last minute.

- Order Pickup: Similar to Drive Up, but instead of waiting in your car, you head into the store to the Guest Services desk to retrieve your pre-bagged order. It's a great option if you need to run another quick errand inside the store anyway.

- Standard Shipping: For non-urgent items, Target.com offers standard shipping right to your door. Shipping is free on orders of $35 or more. If you pay with a Target Circle Card, you get free two-day shipping on most items with no minimum purchase required.

- Same-Day Delivery with Shipt: Need groceries or household essentials in a hurry? Target's Same-Day Delivery service, powered by Shipt, lets you place an order that a personal shopper will fulfill and deliver to your home, often in as little as one hour. This service costs $9.99 per delivery, or is included for free on orders over $35 with a Target Circle 360 membership.

Ultimately, Target’s ecosystem is designed for flexibility. You can start your shopping journey in the app to clip coupons and then finish in the store, or you can do everything from your couch. Using the digital tools, especially the app, is the best way to ensure you're always getting the best possible price, no matter how you choose to get your order.

How Target Stacks Up With Competitors

In the massive world of retail, Target's main competitors are the two giants: Walmart and Amazon. While all three sell a huge range of similar products, from groceries to electronics, they each offer a fundamentally different shopping experience and value proposition. Target has carved out its successful niche not by being the absolute cheapest, but by offering a superior shopping experience and a better-curated selection of trendy, affordable goods.

Here's a breakdown of how Target compares to its biggest rivals.

|

Feature |

Target |

Walmart |

Amazon |

|---|---|---|---|

|

Price |

Competitive, with a focus on value |

The undisputed low-price leader |

Dynamic and very competitive |

|

Key Differentiators |

The "cheap-chic" experience |

Massive, comprhensive selection |

Unmatched online selection |

|

Experience |

Clean, bright, and well-organized stores |

Functional and efficient |

Built for speed and convenience |

|

Deals and Rewards |

Steady stream of stackable coupons |

Free delivery and fuel discounts |

Fast shipping and other perks |

At the end of the day, your preferred store likely comes down to your shopping priorities. If your only goal is to find the absolute lowest price on a specific national-brand item, Walmart or Amazon might win. But Target's magic lies in the overall package. For the shopper who values a clean and pleasant environment, loves discovering stylish and affordable private-label products, and knows how to work the deal-stacking system, Target offers a unique and powerful value that its competitors can't quite replicate.

What to Buy at Target

While you can technically build an entire life with items from a single Target run, the store truly excels in a few key areas where its combination of style, quality, and price is simply unmatched. It's the thoughtful curation and the strength of its massive in-house brand portfolio that set it apart. These are the aisles where you're almost guaranteed to find a great deal on something you'll genuinely love.

- Apparel: Target has become a legitimate fashion destination thanks to its on-trend and affordable owned brands. Look for stylish and comfortable staples from Universal Thread and A New Day for women, sharp and modern pieces from Goodfellow and Co for men, and the wildly popular and durable Cat and Jack line for kids and babies.

- Home Goods: This is where Target's "cheap-chic" reputation was born. Brands like Threshold offer timeless and traditional decor, Project 62 provides a mid-century modern aesthetic, and Hearth and Hand with Magnolia brings Joanna Gaines' signature modern farmhouse style. From bedding and bath to furniture and kitchenware, you can get a high-end look without the sticker shock.

- Groceries: Over the last few years, Target has massively expanded its grocery offerings, centered around its flagship brand, Good and Gather. This line includes everything from pantry staples and frozen foods to a huge selection of organic produce and specialty items, often at a lower price than national brand equivalents.

- Beauty and Personal Care: With the addition of Ulta Beauty shop-in-shops in hundreds of stores, Target is now a powerhouse in the beauty world. You can grab your favorite drugstore brands like e.l.f. and Maybelline alongside premium brands like Tarte and MAC Cosmetics, all while earning rewards for both Target Circle and Ultamate Rewards.

- Household Essentials: Before you splurge on name-brand cleaning supplies and paper towels, check out Target’s Up and Up line. It's their workhorse brand for everyday essentials, offering reliable quality for a fraction of the cost of its competitors.

- Electronics and Entertainment: Whether you're looking for the latest video game console, a new TV, or a pair of headphones, Target has a well-stocked electronics department that's always part of major sale events like Black Friday and Target Circle Week.

- Toys: A trip to Target isn't complete without a stroll down the toy aisle. They carry all the big names like LEGO and Barbie but also have a great selection of their own exclusive toys and games that make for perfect birthday or holiday gifts.

- Baby Essentials: For new parents, Target is a lifeline. From Up and Up diapers and formula to car seats and strollers from top brands like Graco, it’s a one-stop shop for everything you need. Plus, the 15% registry completion discount is a game-changer.

- Seasonal and Holiday Decor: Few retailers do seasonal decor better than Target. Whether it's the spooky-cute Halloween items from Hyde and EEK! Boutique or the festive Christmas decor from Wondershop, these sections are a core part of the "treasure hunt" experience that keeps shoppers coming back.

While Target's broad categories offer consistent value, the real fun lies in discovering the specific items that become cult favorites. These are the products that don't just sell well—they go viral, creating a shopping frenzy that proves the power of a great product at a great price.

Most Popular Items

Every season, a new crop of Target products goes from the shelf to social media stardom, often selling out in the process. In the beauty aisles, this has recently meant the e.l.f. Halo Glow Liquid Filter, a makeup-skincare hybrid that gives you a luminous glow for a fraction of the price of luxury competitors. Another viral sensation has been the Being Frenshe Hair, Body and Linen Mist in the "Cashmere Vanilla" scent, a TikTok-famous spray that shoppers swear makes everything smell like a cozy, high-end hotel. In footwear, it’s all about the dupes; shoppers flock to get their hands on Universal Thread clogs and boots that offer the look of trendy, expensive brands for under $40.

The home goods department is just as famous for its must-have items. The Hearth and Hand with Magnolia line consistently produces hits, like their chic pedestal wood coffee table that looks like a custom piece from a high-end boutique. Everyday essentials also reach hero status, from the perfectly designed Rubbermaid Brilliance food storage containers that our experts love, to the iconic Project 62 upholstered dining chairs that have become a staple in stylish, budget-friendly homes. These items become popular for a reason: they perfectly embody the Target promise of delivering exceptional style and function at a price that feels like a steal.

Need to Cancel a Target Order? Here’s How

So, you clicked "Place Order" a little too fast and are now having second thoughts. Don't worry, it happens to the best of us during a late-night Target browsing session. While Target processes its online orders very quickly, you do have a small window of opportunity to cancel an item before it ships. The key is to act fast.

How to Cancel a Target Order

The easiest way to request a cancellation is through your Target.com account or the Target app. Head to your "Purchases" or "Order History" and find the order you want to change. If the items haven't been prepared for shipping yet, you'll see an option to "Cancel items."

- Find your order in your purchase history.

- Select "Cancel items" next to the product you no longer want.

- Choose a reason for the cancellation from the dropdown menu.

- Confirm your choice by selecting "Cancel item."

You'll receive an email shortly after confirming whether the cancellation was successful. If the "Cancel items" option is no longer visible, it means the order is already being processed by the warehouse. At that point, your best bet is to wait for the item to arrive and then make a return. For Drive Up or Order Pickup items, you can simply not pick up the order; Target will automatically cancel it and issue a refund after a few days.

The Target Return and Refund Policy

Target's return policy is one of the most generous in retail, making it easy to shop with confidence. For most new, unopened items, you have a full 90 days to make a return for a full refund or exchange. If you paid with a Target Circle Card, that window is extended by an extra 30 days, giving you four months to decide. The real standout, however, is the policy for Target's owned brands. Any item from a Target-owned brand—like Cat and Jack, Good and Gather, or Threshold—can be returned within one year with a receipt if you're not satisfied with its quality.

Refunds are typically issued to your original form of payment. If you're returning an item in-store, the refund is processed immediately. For mail-in returns, expect the refund to be processed once the item is received and inspected at the warehouse. The easiest way to handle returns is through the Target app, where you can generate a return barcode for in-store returns or initiate a Drive Up return, which lets you hand off your item without even leaving your car.

The Target Price Match Guarantee

Target is serious about offering competitive prices, and their Price Match Guarantee is proof. If you buy an item at Target and then find an identical item for a lower price at Target.com, a local Target store ad, or on a qualifying competitor's website (including major players like Amazon and Walmart), they will match that price. The policy is valid both at the time of purchase and for up to 14 days after your purchase.

To get a price match in-store, just show the lower price from the qualifying ad or website to a team member at checkout or Guest Services. For online orders, you can call or use the online chat feature to request an adjustment. Keep in mind that you can't combine a price match with a Target Circle percentage-off offer on the same item, but you can still use your Target Circle Card for an additional 5% off the newly matched price.

Target FAQs and Terms to Know

We've covered a lot of ground, but there are always a few more details that can help you become a true Target shopping pro. From understanding the store's holiday hours to knowing the secrets of where unsold clearance items end up, these final tips will round out your expert-level knowledge and ensure you're always prepared for your next Target run.

One of the most common questions is about holiday hours. While Target stores are open for extended hours during the busy November and December shopping season, they are famously closed on Thanksgiving Day and Christmas Day to give team members time with their families. For other major holidays like Easter and the Fourth of July, hours can vary by location, so it's always best to check your local store's schedule in the Target app or online before you head out.

For the most dedicated deal hunters, it’s worth knowing about Target salvage stores. These aren't official Target stores, but rather third-party liquidation retailers (like Goodwill, Bargain Hunt, or Ollie's Bargain Outlet) that purchase Target's unsold clearance and overstock inventory. At these stores, you can often find Target-owned brand items like Threshold home goods or Cat and Jack apparel for up to 90% off the original price. The inventory is unpredictable and requires some digging, but the potential for incredible bargains is huge.

Of course, with so many programs and policies, it's impossible to cover every single detail. For the complete, official rules on everything from your account to promotions and returns, you can always refer to Target's full Terms and Conditions. And if you ever run into an issue with an order or just have a question, the Target Help Center is your best resource, with detailed answers to just about any question you can think of.