How Much is Amazon Prime Video? January 2026's Monthly Pricing & More

The streaming platform behind originals like The Marvelous Mrs. Maisel, The Boys, and Jack Ryan, Prime Video continues to gain popularity as part of Amazon Prime membership. The service is well-known for a wide variety of content, including TV shows, movies, award-winning originals, and live sports.

SEE ALSO: This Year's Most Popular Early Prime Day Deals To Save With, From Laptops To Headphones

In 2024, Prime Video introduced limited ads during movies and shows, aiming to increase revenue to reinvest in providing more content. The move coincided with the launching of a tiered subscription model similar to its competitors.

How Much is Amazon Prime Video Per Month This January?

Amazon Prime Video

Free w/ Amazon Prime SubscriptionAmazon Prime offers a ton of benefits, but one you might not be using to the fullest is Amazon Prime Video. It's the Amazon streaming service that serves as a Prime benefit in 2025 and offers an extensive catalog of TV shows, movies, and Amazon Originals, all at no extra cost!

Paramount+ Channel on Amazon Prime Video

Free 7-Day TrialPrime members can take advantage of this deal in 2025 and get seven days of the Paramount+ channel for free. Be sure to cancel before your trial is up if you're not feeling it. Otherwise you'll be charged the then-current rate for whatever Paramount+ plan you chose to try out.

Apple TV+ Channel on Prime Video

Free 7-Day TrialAmazon Prime subscribers can add Apple TV+ to their Prime Video lineup in 2025 and get a free 7-day trial to see what all the service has to offer! Be sure to cancel before your trial is up; otherwise it'll cost $9.99 per month for the add-on. But for those that want to keep all their streaming services in one place, this is a great way to consolidate!

Max Channel on Prime Video

Free 7-Day TrialAmazon Prime subscribers can add Max to their Prime Video lineup in 2025 and get a free 7-day trial to check out everything the service has to offer. Be sure to cancel your trial before it's up; otherwise, you'll be charged on a monthly basis for whatever Max plan you chose (the cost starts at $9.99 per month). But for those users who want to keep all their streaming services in one place for easy management, this is a great way to consolidate!

Amazon Prime Video Select Content

Free w/ adsCurious about what kinds of things you can watch on Amazon Prime Video in 2025? The good news is select content is totally free - you just need a regular Amazon account and you can enjoy a variety of ad-supported shows and movies. But if you decide you'd rather not deal with ads, you can join Prime Video as a standalone service for just $8.99 per month and pay an additional $2.99 per month ($11.98 total) and get ad-free viewing of things like Invincible, The Boys, and more. Of course, if you want even more perks, it's worth signing up for Amazon Prime at $14.99 per month and getting things like free shipping and exclusive discounts as well.

What Does Prime Video Cost in 2026?

|

Subscription Type |

Monthly Cost |

Annual Cost |

|---|---|---|

|

Amazon Prime Membership |

$14.99 |

$139 |

|

Standalone Prime Video |

$8.99 |

$107.88 |

Pricing for Prime Video is expected to remain stable in 2025, with only minimal adjustments to stay competitive within the streaming market. Prime Video will continue to offer flexible pricing options, including standalone subscriptions for $8.99 per month and bundled with Amazon Prime for $14.99 per month. Subscribers can go ad-free for only $2.99 more per month, giving them more control over their entertainment.

This structure ensures that Prime Video remains accessible to all audiences, with price points catering to casual viewers and Amazon Prime members. Sales occur regularly, with notable discounts during promotional periods like Black Friday and Amazon Prime Day.

Promotions like free trials and discounts will remain a staple for drawing in new subscribers, while the platform's integration with other Amazon services provides a strong incentive for those looking to consolidate their subscriptions.

Features and Benefits

As with everything else associated with Amazon, Prime Video aims to be a one-stop shop for streaming. The user-friendly platform provides tons of entertainment options, and subscribers can even purchase or rent additional media for a small fee.

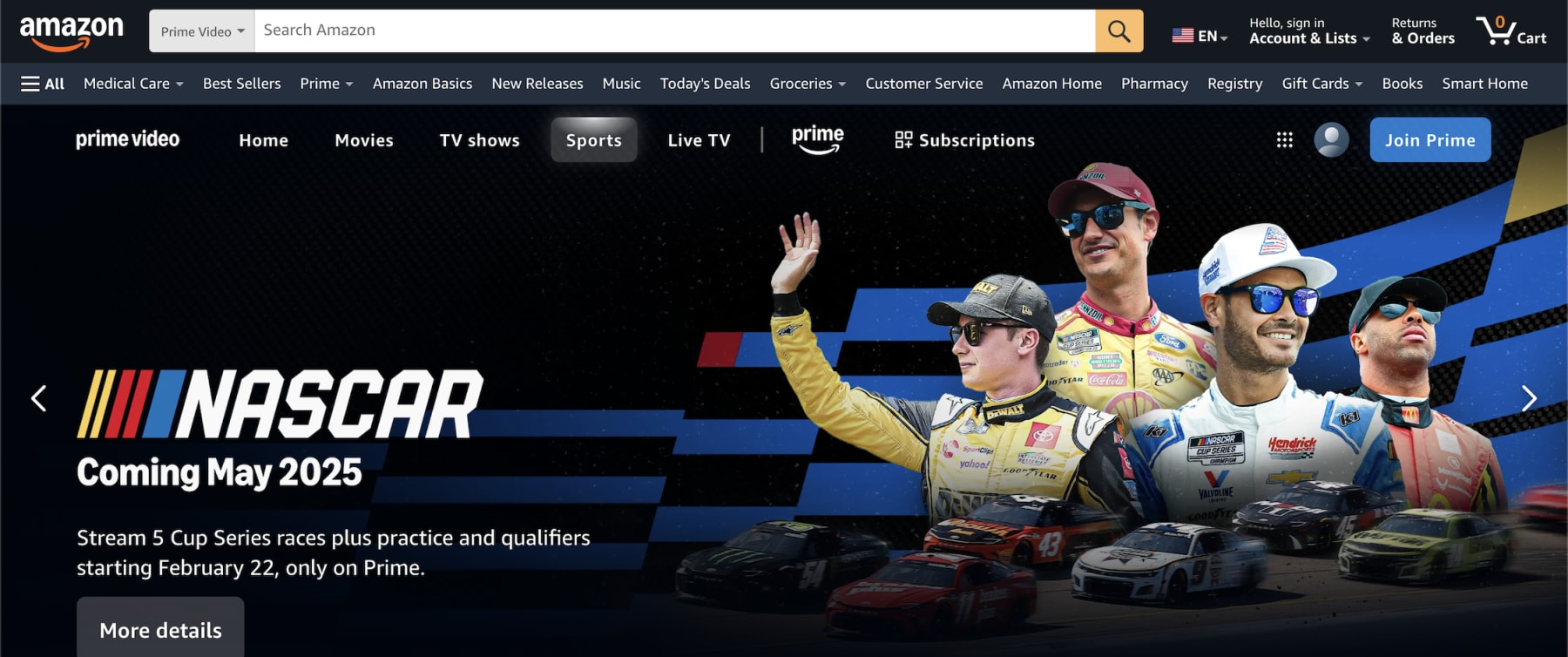

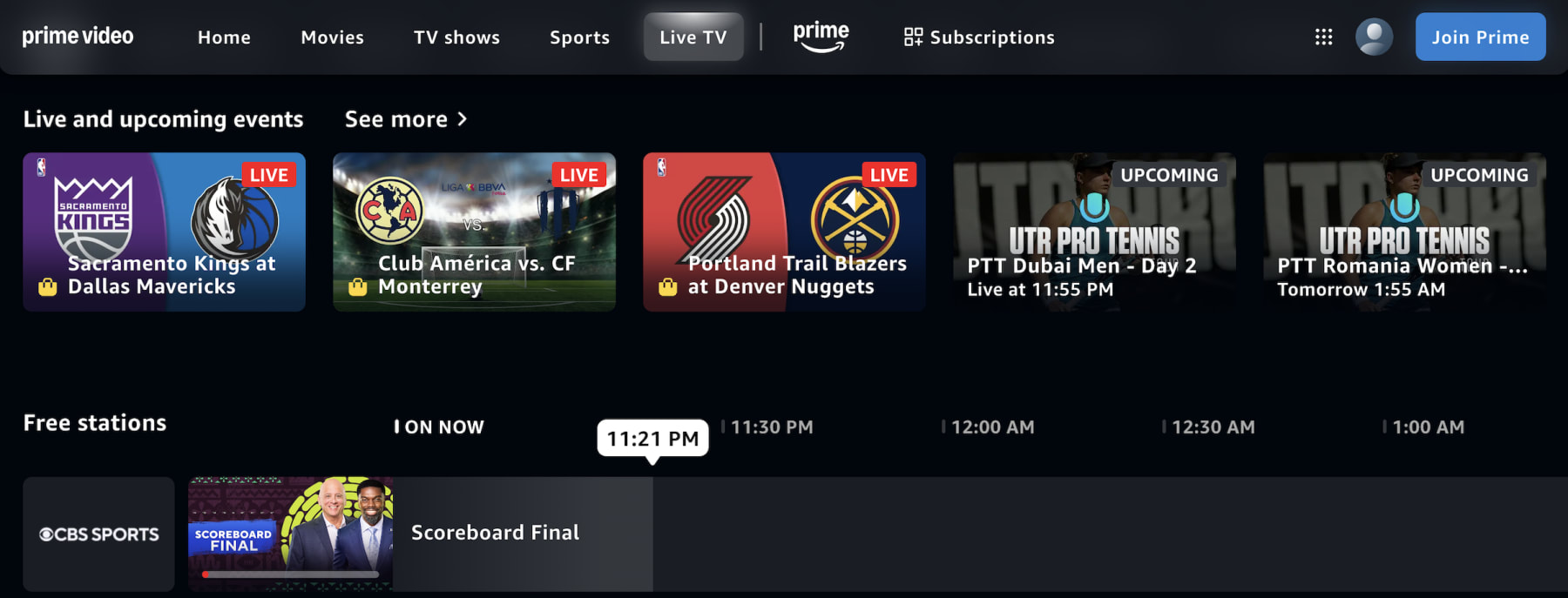

Diverse Content and Live Sports

Prime Video provides a rich on-demand streaming experience through live sports and premium entertainment. Subscribers can enjoy a vast selection of original series, ranging from The Grand Tour to The Summer I Turned Pretty, along with an ever-growing library of critically acclaimed films and TV shows.

Live events, including exclusive NFL Thursday Night Football coverage, set Prime Video apart from competitors. For those looking to expand their viewing options, Prime Video allows access to premium add-on channels like Max, Showtime, and Starz, and even select local television stations.

Add-Ons and Additional Content

Prime Video's add-ons give subscribers the freedom to customize their entertainment experience. Users can subscribe to more than 100 additional channels, including Paramount+, Starz, and niche streaming services, for an extra monthly fee.

For even more flexibility, Prime Video offers a purchase and rental option, providing access to newly released films and exclusive content not a part of the standard subscription. Special discounts are frequently available for students, veterans, and teachers, making premium entertainment more accessible to a broader audience.

Bundling and Promotions

New and returning subscribers can often take advantage of a 30-day free trial, providing a risk-free opportunity to explore the platform's extensive content library. Students currently even get a six-month free trial. Bundling Prime Video with an Amazon Prime membership adds value through free shipping, music streaming, and exclusive shopping deals. With regular discounts and promotional codes available, many subscribers find opportunities to save.

Comparison With Other Streaming Services

Prime Video's strengths and weaknesses are better understood when compared with other streaming platforms. Here's a brief analysis:

|

Streaming Service |

Monthly Cost |

Key Features |

Best For |

|---|---|---|---|

|

Prime Video |

$14.99/mo with Prime or $8.99/mo |

4K, HDR, live events, additional content rental |

Amazon shoppers, sports fans |

|

Netflix |

Starts at $7.99/mo |

Original content, multi-device support |

Original series enthusiasts |

|

Hulu |

Starts at $9.99/month (with ads) |

Live TV options, next-day TV episodes |

TV show binge-watchers |

|

Disney+ |

$9.99/month (with ads) |

Extensive Disney, Pixar, Marvel content |

Families, Disney fans |

|

Max |

$9.99/month (with ads) |

Extensive library of HBO and Warner Bros. titles |

Viewers with tailored preferences |

Prime Video Cost in Previous Years

Amazon Prime has gradually adjusted its rates to reflect the growing value of the overall membership, which bundles Prime Video with other services. Historically, the cost of Amazon Prime has gradually increased, from $99 annually at launch to its current $139 per year, with corresponding monthly subscription price increases.

Amazon has grown the value of Prime Video memberships by offering customers access to more than just streaming. Users receive perks like free shipping, Amazon Music, and exclusive shopping deals. The introduction of standalone Prime Video subscriptions and an ad-free option further caters to users seeking only the video service or a more streamlined viewing experience without interruptions.

When Is The Best Time to Save on Prime?

Peacock offers discounts during Black Friday, Cyber Monday, and through promo codes.

How Long Do Discounts Last?

Depending on the specific promotion, Amazon discounts can last as short as one week and run up to three months or more.

How Are Deals Sourced and Published?

Our team of deal curators scour every corner of the internet to find the best Amazon deals for you, our readers. By monitoring provider websites, industry news, and promotional events, we make sure to provide the freshest deals for all ages.

Prime Video Or Alternatives?

Prime Video adds value beyond entertainment offerings through an all-in-one approach, particularly appealing to users who want a comprehensive membership — not just a single-streaming service as seen below:

|

Feature |

Prime Video |

Netflix |

Hulu |

Disney+ |

Apple TV+ |

|---|---|---|---|---|---|

|

Price Range |

$8.99–$14.99/mo or $139/yr |

$7.99–$24.99/mo |

$9.99–$18.99/mo |

$9.99–$15.99/mo or $159.99/yr |

$9.99/mo |

|

Number of Movies and TV Shows |

Over 25,000 |

Extensive library |

Broad TV show catalog |

Extensive Disney catalog |

Smaller, carefully curated |

|

Original Content |

Limited but growing |

Extensive |

Moderate |

Moderate |

High-quality originals |

|

Live Sports |

Available (e.g., NFL, NBA) |

Limited |

Extensive (Live TV optional) |

Limited |

Limited |

|

Ad-free Option |

Available for extra charge |

Yes |

Yes |

Yes |

Yes |

|

Additional Perks |

Amazon Prime benefits |

None |

Hulu bundles with ESPN+ |

Disney bundle with Hulu, ESPN+ |

None |

With continuous investment in original content and exclusive features, Prime Video remains a key player in the competitive streaming landscape.

Why Trust DealNews

DealNews was founded in 1997, giving DealNews over 25 years of experience in finding the best deals across different categories of services and products.

Interested in saving money on your favorite streaming discounts? Sign up for the DealNews Select newsletter to receive emails with some of the hottest deals every weekday. Make the most of these deal offerings by setting a deal alert for products you're interested in.

Related Blog Posts:

- There are several newer streaming services available now, and Fubo is one of the cheaper options as covered in our 2025 price breakdown.

- Discover the perks of Amazon Prime membership, from free shipping to streaming: Amazon's Membership Pricing. Make the most of your subscription with these tips.

- With their flexible pricing and bundle packages, Disney Plus is one of the top streaming options this year. Check out our subscription pricing overview when factoring in your budget.

Sign In or Register