When Is Your State's Tax Free Weekend?

NOTE: The information below is from 2022, but the same states tend to have tax free weekends from year to year. While you won't find a tax free weekend everywhere in 2023, it's worth checking with your state's department of revenue, finance, or its comptroller to see if sales tax holidays are available where you live. Want to maximize your savings during no-tax days? Check out our guide to Back to School sales in 2023, plus the tax holiday pages at stores like Apple, Walmart, and Lenovo.

Whether you call it a tax free period or the jauntier tax holiday, 2022 seems to be the year of the sales tax break!

Tax free periods allow consumers to shop without the additional financial burden of a sales tax. Better still, most states host their events toward the end of the summer as Back to School shopping begins in earnest.

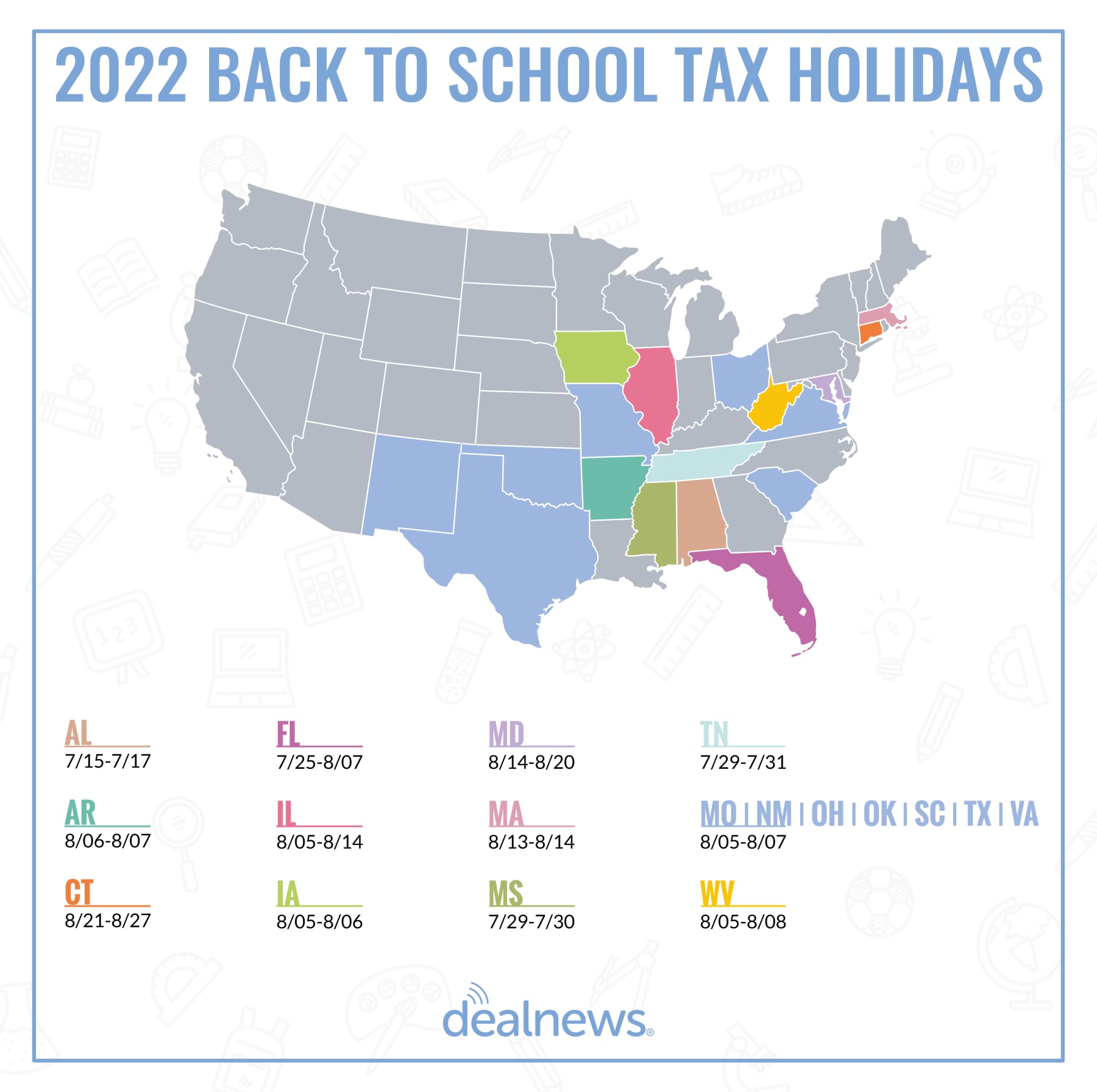

To find out when the tax free day, tax free weekend, or even tax free week is happening in your state, look no further than our infographic and guide below!

When Is Your State's Tax Free Weekend in 2022?

Alabama

2022 Tax Free Days: February 25-27, July 15-17

Alabama has been hosting tax free weekends since 2006. The first of two annual tax holidays falls in February and is referred to as a "severe weather preparedness" event. But the state's second tax free weekend of the year happens annually over three days, beginning on the third Friday in July. This year it'll be held July 15-17.

Qualifying items include:

- Clothes priced at $100 or less

- Computers and software that are priced below $750 per item

- School supplies under $50

- Books under $30

Arkansas

2022 Tax Free Days: August 6-7

Arkansas hosts a single tax free weekend, which in 2022 will fall on Saturday, August 6, and Sunday, August 7.

Shoppers can buy clothing items for under $100 each as well as school supplies, including:

- Art supplies

- Instructional materials

- Electronic devices

Connecticut

2022 Tax Free Days: April 10-16, August 21-27

Like Alabama, Connecticut is hosting two tax-exempt shopping holidays this year, the first of which fell in April. The good news is that Connecticut's Back to School sales tax free period lasts an entire week! This year, it'll occur from August 21-27.

Clothing items under $100 — even vintage and antique clothing, as well as rented uniforms — are exempt, along with:

- Shoes

- Baby bibs

- Professional uniforms, like chef's clothing

- Ponchos and warm-weather outerwear

- Baseball hats

- Lingerie

Be aware that some items may be taxed even if they're sold for under $100; some of these include:

- Jewelry

- Sports uniforms and helmets

- Ice skates

- Wallets

- Wet suits

Florida

2022 Tax Free Days: May 14-August 14; May 28-June 10; July 1-7; July 1, 2022-June 30,2023; July 1, 2022-June 30, 2024; July 25-August 7; September 3-9; October 1-31

In 2022 Florida is going all out with their tax free periods. This year they're offering sales tax exemptions a whopping nine times — that's a big leap compared to 2021, when they only offered three.

SEE ALSO: What to Expect From Back to School Sales

Crucially, from July 1-7, you can pay for certain outdoor-activity items as well as admissions to entertainment and cultural events without incurring a state tax.

Additionally, this year from May 14-August 14, children's books are tax exempt. Perhaps even more appealing, diapers and children's clothing are being sold tax free from July 1, 2022-June 30, 2023.

For people who enjoy a 2-year window to do their shopping, storm preparedness also has a tax free period in Florida. From July 1, 2022, until June 30, 2024, Floridians can buy storm windows and hurricane hardened doors sans tax. Florida also hosted a disaster preparedness tax free period in the spring, so look for that again in 2023 if you missed it this year.

For items like school and work supplies, Florida is offering tax exemptions from July 25-August 7, including:

- School supplies under $50

- Computers up to $1,500

- Clothing items that are $100 or less

And from September 3-9, find work items tax free, such as:

- Work gloves up to $25

- LED flashlights for $50 or less

- Bags that fall at a price point of $50 or less

Illinois

2022 Tax Free Days: August 5-14

Illinois doesn't offer a full tax holiday period, per se, but they do offer a reduced-tax period. Between August 5 and August 14, consumers are offered a reduced sales-tax rate for Back to School shopping, including clothing for under $125 and certain school supplies. During this period, the state portion of the sales tax will be only 1.25% — that's a significant decrease from the standard 6.25% sales tax rate during the rest of the year.

Iowa

2022 Tax Free Days: August 5-6

For two days in Iowa in 2022, there will be no sales tax on clothing that's up to $100 per item. The tax holiday will start at midnight on the first Friday in August and end the next day at 11:59 pm. That means this year, the tax free weekend will fall between Friday, August 5, and Saturday, August 6.

Tax-exempt items include "any article of wearing apparel and typical footwear intended to be worn on or about the human body," according to the Iowa Department of Revenue.

This does not include products like:

- Jewelry

- Umbrellas

- Most sports or athletic equipment

- Watches

- Handkerchiefs

Maryland

2022 Tax Free Days: February 19-21, August 14-20

Maryland's second sales tax exemption period of the year will begin August 14 and last a week, ending on August 20. Their first was held in February and was exclusively for Energy Star products and solar water heaters.

SEE ALSO: How to Shop and Save on Kids' Adidas Items

Maryland's second event is simple, as clothing and shoes sold for $100 or less are included in this tax holiday.

Massachusetts

2022 Tax Free Days: August 13-14

Massachusetts only offers two days a year where they don't collect sales tax, but their tax free event is a doozy. From Saturday, August 13-Sunday, August 14, 2022, shoppers can buy retail items costing up to $2,500 without paying sales tax.

However, the following items are not included:

- Meals

- Motor vehicles

- Motorboats

- Telecommunications services

- Gas

- Steam

- Electricity

- Tobacco products

- Marijuana products (including marijuana)

- Alcohol

Mississippi

2022 Tax Free Days: July 29-30, August 26-28

Mississippi hosts two tax free holidays back to back — one for Back to School and another for hunting season.

The tax free day for clothes and footwear — i.e., the Back to School one — starts on July 29 and ends on July 30.

But hunters get an extra day — on August 26, 27, and 28, the state of Mississippi will allow shoppers to buy certain hunting supplies with zero sales tax.

Missouri

2022 Tax Free Days: April 19-25, August 5-7

Missouri hosts a tax free week in April for Energy Star products. However, from August 5-7, shoppers can get sales tax exemptions for Back to School shopping.

Included in this tax holiday are:

- Traditional school supplies such as backpacks, notebooks, pens, folders, etc., up to $50 per purchase

- Computers up to $1,500

- Printers up to $1,500

- Software up to $350

- Clothing that costs up to $100

Nevada

2022 Tax Free Days: October 28-30

Nevada's tax holiday is an exclusive event that falls relatively late in the year. Between October 28 and October 30, National Guard members and certain family members can shop tax free in Nevada. (National Guard members can also take advantage of military discounts throughout the year.)

SEE ALSO: Which Back to School Supplies Should You Buy? (And Which Ones Should You Skip?)

Tennessee

2022 Tax Free Days: July 1, 2022-June 30, 2023; July 29-31; August 1-31

Tennessee actually has three sales tax exemption periods: one for gun safety, one for food and food ingredients, and the third for Back to School shopping. The school-related tax free weekend falls from July 29-31, during which you can buy clothes, school supplies, and computers.

Additionally, from August 1-31, grocery sales tax will be suspended on food and food ingredients.

Then, for a full year, which began July 1, 2022, and ends June 30, 2023, you can purchase gun safes and safety devices, all tax free.

What About the Sales Tax Holidays in Other States?

2022 Tax Free Days: August 5-7, August 5-8

New Mexico, Ohio, Oklahoma, South Carolina, Texas, Virginia, and West Virginia are all hosting their sales tax holiday weekends beginning on August 5. They'll end on Sunday, August 7, with West Virginia's extending to August 8.

Each state will provide tax exemptions on clothing. Ohio will offer them on items of $75 or less, while Oklahoma, Texas, and Virginia will cap items at $100, and West Virginia will offer an exemption on items up to $125.

All but Oklahoma will include school supplies in their events, with New Mexico and South Carolina also offering exemptions on computers and computer equipment.

Virginia's tax holiday also provides exemptions to Energy Star products costing up to $2,500, as well as certain hurricane preparedness items that cost $60 or less and generators up to $1,000.

West Virginia's holiday, meanwhile, allows for the tax-free purchase of sports equipment up to $150 and tablet computers costing up to $500.

Don't have a tax free holiday in your state? You can still save by shopping our best deals available right now!

- Peacock's current promo codes can help you save faster than ever.

- Getting price adjustments on items you've purchased can make it easier to take the plunge when shopping at Amazon. Learn more with our 2025 overview .

- Check out our 2025 guide on how to save the most.

- If you're interested in Paramount Plus but want to save, we have the discount breakdown you need.

Sign In or Register