Apply coupon code "RIM38DZQ" for a savings of $22. Buy Now at Amazon

- 5200°F fireproof and waterproof

- 8 layers of heat insulated foil

- Large capacity with multiple compartments

- Keyless combination lock for security

- Ergonomic handle and back strap for travel

As part of Best Buy's Apple Shopping Event, save $30 on different AirPods iterations. We've pictured the Apple AirPods Pro 3 for $219.99 ($250 most stores). Buy Now at Best Buy

Clip the $33 off coupon on the page and apply code "CJOOC5D7" for a savings of $52. Buy Now at Amazon

- IPX8 waterproof

- Bluetooth 5.3 technology

- Fast charging capability

- 10mm driver for clear sound

- CVC 8.0 noise reduction

It's a savings of $18 and within a few bucks of its lowest-ever price. Buy Now at Amazon

Prime members can apply coupon code "78PFSMGB" for a savings of $24. Buy Now at Amazon

- 2.6ft 4 inch aluminum duct

- Strong magnetic quick connect

- Suitable for 90° dryer venting

- Includes adapter and clamps

- Durable aluminum and stainless steel

You'd pay $4 more elsewhere. Buy Now at Amazon

It's the best price that Amazon has charged for this 6-pack of bungee cords. Buy Now at Amazon

It's the best deal we could find by $6. Buy Now at Amazon

Apply coupon code "9U59S4RU" for a savings of $19. Buy Now at Amazon

- three color temperatures

- dimmable

- timer

- 4,400mAh battery

Lensmart reduces prices on its glasses from $24.95 to as low as $14.95. Plus, get an extra 15% off all orders with coupon code "DEALNEWS" at checkout as well as buy one pair of glasses and get a second pair for 50% off. Shipping adds $5.90, but orders of $65 or more get free shipping. Buy Now at Lensmart

Apply coupon code "4VQ3XTG2" for a savings of $40. Buy Now at Amazon

- 110V IGBT inverter technology

- 20 to 120 amp adjustable current

- 3.3 lbs lightweight design

- Supports 3/32" to 1/8" rods

- Includes 20 welding rods and accessories

Clip the $3 off coupon on the page and apply code "9VAH4H4T" for a savings of $18. Buy Now at Amazon

- Uses natural peppermint oil

- Repels, not harms rodents

- Safe around kids and pets

- Covers up to 120 sq ft

- Lasts up to 60 days

It's the best price that Amazon has charged for the Peachtree Thin Rip Jig. Buy Now at Amazon

Get this price with promo code "EXTRA50". That's the lowest we've seen them for and $13 less than what you'd be elsewhere. In several colors (Black/Red/White pictured). Shipping adds $8 or is free with orders of $50 or more. Buy Now at Under Armour

Get this price with promo code "EXTRA40". In Camel or Black. Buy Now at Merrell

That's around half what you'd pay elsewhere. Buy Now at Amazon

The first official day of spring is right around the corner, and that means it's time to tend to the yard and garden if you haven't started already. In that spirit, Lowe's has discounted Sta-Green mulch varieties to just $2.50 per bag (not quite as good as the 5 for $10 offer we sometimes see, but a great deal nonetheless). Select from Red, Brown, and Black. Choose pickup to avoid delivery costs. Selection and availability will vary by zip code, so be sure to check with your local store before you head out. Buy Now at Lowe's

Apply promo code "EXTRA50" on over 80 pairs of leggings and pants, with baseball pants starting from $17, fleece pants from $20, leggings from $21, and more. We've pictured the Armour Men's Fleece Pants for $20.49 ($21 savings). Shipping adds $8, but order over $50 ship for free. Buy Now at Under Armour

It's the best price we could find by $125. Buy Now at Walmart

adidas men's Terrex shoes are all discounted by an extra 15% when you apply the promo code "OFF15". It stacks with the already-existing discounts of up to 50%. Pictured is the adidas Men's Tracefinder Trail Running Shoes for $45.05 after code (reduced from $70). Plus, adiClub members will get free shipping on all orders (it's free to sign up). Buy Now at adidas

Apply coupon code "DWJ8WAZ4" for a savings of $36. Buy Now at Amazon

- Diamond-Like Carbon Blades

- 9000 RPM motor

- Cordless with USB-C charging

- 10 guide combs included

- Interchangeable grip covers

Apply coupon code "DFE2WMVA" for a savings of $14. Buy Now at Amazon

- rust resistant

- includes 10 pieces of fence and 11 metal stakes

That's a 50% savings. Greater Rewards members receive free shipping (it's free to sign up). Buy Now at Columbia

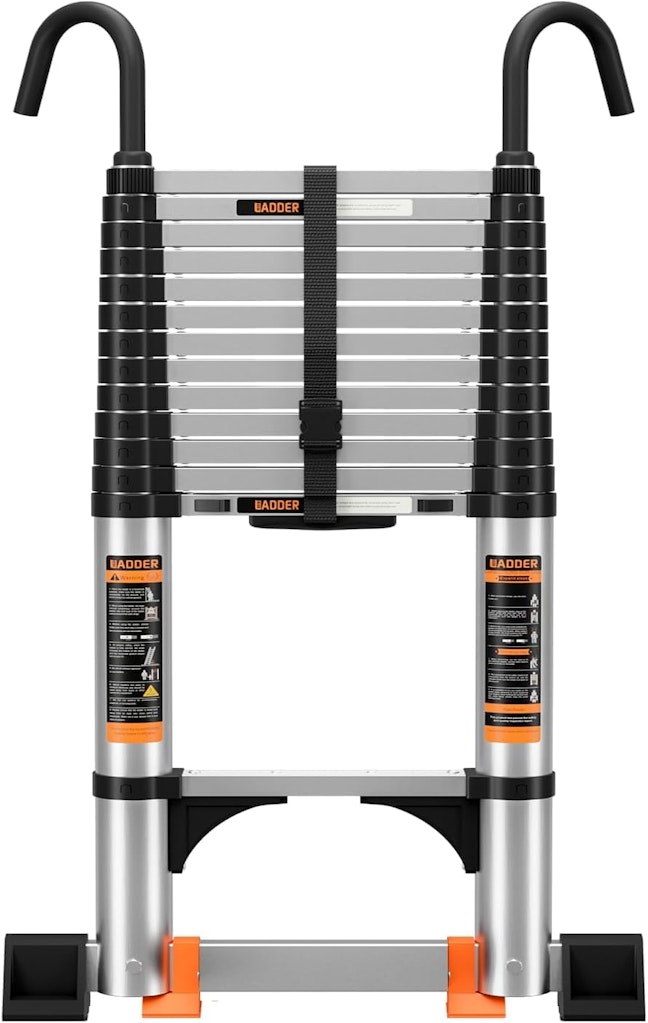

Apply coupon code "RAHEHICO" for a savings of $47, and $12 less than the last time we listed it. Buy Now at Amazon

- One-button fast retraction

- Stable design with stabilizer bar

- Supports up to 330 lbs

- Compact and easy to store

- Includes stabilizer bar and hooks

Use promo code "VIPOUTLETMARCH" to get this price and beat what other stores charge by $120. Coupon expires April 1 at 3am ET. Buy Now at eBay

Apply coupon code "SUYAD3CI" for a savings of $20. Buy Now at Amazon

- 2 x 3.0Ah batteries

- Compatible with 20V PowerShare tools

- 50% longer run time than 2.0Ah

- Includes noise-cancelling earplugs

- Intelligent protection system

Get his price with promo code "EXTRA40". You'd pay $65 more elsewhere. Buy Now at Merrell

After 5pm on Fridays, Saturdays, and Sundays in participating locations, Schlotsky's offers Core Pizzas for $5 and Premium Pizzas for $7.

If you're in the mood for fast food, you can save even more with these Uber Eats promo codes. Buy Now at Schlotzsky's

Use the promo code "SPRING26" here, and you'll get a $45 Costco Shop Card for free when you sign up for a Costco Gold Star annual membership. You will receive the card within two weeks of signing up. This membership offer is available only to new Costco members or to those whose membership has expired for 18 months or more. This offer ends April 12, 2026. Buy Now at Costco

It's the best deal we could find for the Puma Men's GS-One Shoes by $33. Buy Now at eBay

Get this price with promo code "EXTRA50". You'd pay over $50 elsewhere. Shipping adds $8, or is free with orders of $50 or more. In a range of colors (Blue pictured; the $40 styles drop to $20 with the code.) Buy Now at Under Armour

Apply coupon code "EMVNN9KS" for a savings of $14. Buy Now at Amazon

- Remote changes brightness and mode

- 30+ hours on single charge

- Solar and USB charging options

- Easy installation with plugs or screws

- Built for outdoor durability

Apply coupon code "XFGBXK2Y" for a savings of $42. Buy Now at Amazon

- Quick Connect & Disconnect

- Safety & Reliability

- Airtight Connection

- Cover Larger Area

Apply promo code "USAFF9" to save an extra $9. It ships for free from a U.S. warehouse. Buy Now at AliExpress

- 350W

- 35 backlight colors and 5 brightness levels

- supports various types of high-power digital and tube amplifiers

It's the best price we could find by $11 and a great deal for The North Face Men's TKA Glacier 100 Fleece 1/4 Zip Jacket. Buy Now at eBay

It's the best deal we could find by $6. Buy Now at Amazon

Use promo code "DEALNEWS199" for an extra $401 off. Buy Now at VOSS + AGIN

- 14K White or Yellow Gold Over Sterling Silver Settings

- G/VS Clarity

- Ethically Crafted in USA

You'd pay over $100 elsewhere. In several colors (Black/Purple Hi-Vis pictured). Timberland Community members bag free shipping with orders of $75 or more, and it's free to join. For orders under $75, shipping adds $5. Buy Now at Timberland

This 5-night Moorea vacation package in French Polynesia features an overwater bungalow stay at the Manava Beach Resort & Spa, international flights from select U.S. gateways, ferry transfers between Tahiti and Moorea, daily breakfast, and several included experiences such as a couples spa treatment and guided excursions. Plus, couples on honeymoon also receive a Tahitian Black Pearl. Book this travel deal by March 31.

Satisfy your wanderlust - and your wallet - by taking a look at all our top travel deals. Buy Now at Tahiti.com

Apply promo code "9MI9QXZ8" to save 50% on all the options. Buy Now at Amazon

- Forged Sharpe Blade

- Perfectly complete Every Kitchen Task

- Comfortable and balanced

- Effortless Care & Tidy Storage

Apply coupon code "EY4VDMGQ" for a savings of $15. Buy Now at Amazon

- 8 AC and 6 USB ports

- Compact design for space saving

- 6.5 x 4.3 x 1 inches dimensions

- 1250W/10A power capacity

- Includes overload and surge protection

- Flat plug with 45-degree angle

That's a savings of $7. Buy Now at Amazon

Prime members can apply coupon code "MZJJG5YO" for a savings of $19. Buy Now at Amazon

- 24 LEDs per light

- Weatherproof IP65 rating

- Ultra-thin solar panels

- Automatic dusk to dawn operation

- 8 hours of light per charge

Apply coupon code "G5DE996D" for a savings of $12. Buy Now at Amazon

- Lightweight, quick-drying fabric

- Two zippered pockets and extra interior pocket

- Elastic waistband with drawcord

- Tapered fit with cuffed ankles

- Ideal for various activities

Get this price with promo code "EXTRA40". You'd pay $110 elsewhere and it's the lowest we've seen them for. In several colors (Ridgeway pictured). Buy Now at Merrell

Use promo code "VIPOUTLETMARCH" to get this price. That's $73 less than what Walmart currently charges for the same model. Coupon expires April 1 at 3am ET. Buy Now at eBay

Apply coupon code "KTB18" for a savings of $40. Buy Now at Koulb

Apply coupon code "S3TJK45M" for a savings of $4. Buy Now at Amazon

- 1080P HD camera with LED lights

- Supports iOS and Android

- Includes 6 ear scoop tools

- Rechargeable 350mAh battery

- IP67 waterproof for easy cleaning

Now through March 24, New and eligible returning Disney Plus subscribers can save over 60% when they sign up for the Disney+ and Hulu bundle. Current Disney+, ESPN, Hulu, and bundle subscribers are not eligible. Eligible subscribers will get the ad-supported Disney+, Hulu Bundle plan for $4.99 per month for 3 months, then it will auto-renew at $12.99 per month or the then current regular monthly price. Ends 8:59 AM PDT on 3/24/26. U.S. residents, 18+ only. Cancel anytime, effective at the end of your billing period. This offer ends March 24, 2026 at 11:59 AM ET. Buy Now at Disney+

How Much Can I Save on the Hottest Deals?

The average savings can vary wildly day by day, but we regularly see discounts of anywhere from 15% to 96% off. The biggest discounts usually pop up for holidays, such as these Early Prime Day Deals. Thanks to coupon codes giving extra discounts, we'll regularly see shoes and apparel from the biggest brands like Nike, adidas, and New Balance at over 50% off. If you're looking for tools or home improvement, we see deals from stores like Home Depot and Lowe's that take up to 70% off. Plus, if something's at its best-ever price, or close to it, or is just something we think is extra neat, you'll probably find it on our Staff Picks page.

How Often Are the Hottest Deals Updated?

Around the clock! An international team of highly-trained deal jockeys is constantly scouring Amazon, Walmart, Best Buy, Target, and any other store you care to name, seeking out the latest and greatest deals for you to peruse. From daily deals and doorbusters to niche finds and off-the-wall offers, our pages are always being updated with something new and interesting and discounted.