5 Deals You Need to Know Today: PRIME DAY EBBETH

Prime Day is over! Long live Prime Day! Check out this offer and more in our roundup of the five best deals we found over the last 24 hours.

Top Electronics Deal

Prime Day Tech Leftovers at Woot

Up to 80% offPrime Day is over, all 96 hours of it. But nobody has informed Woot (which seems embarrassing since they are, lest we forget, an Amazon company), and so here we are with a whole host of Prime Day leftovers. Reheated leftovers, however, are some of the best things in life, so please calmly and efficiently put some of these deals in the low oven that is your shopping basket and proceed to consume. I've lost track of this metaphor and now it's in control. The savings are delicious. The shipping is free with Prime. Rib.

Top Crafts Deal

Cricut EasyPress Mini

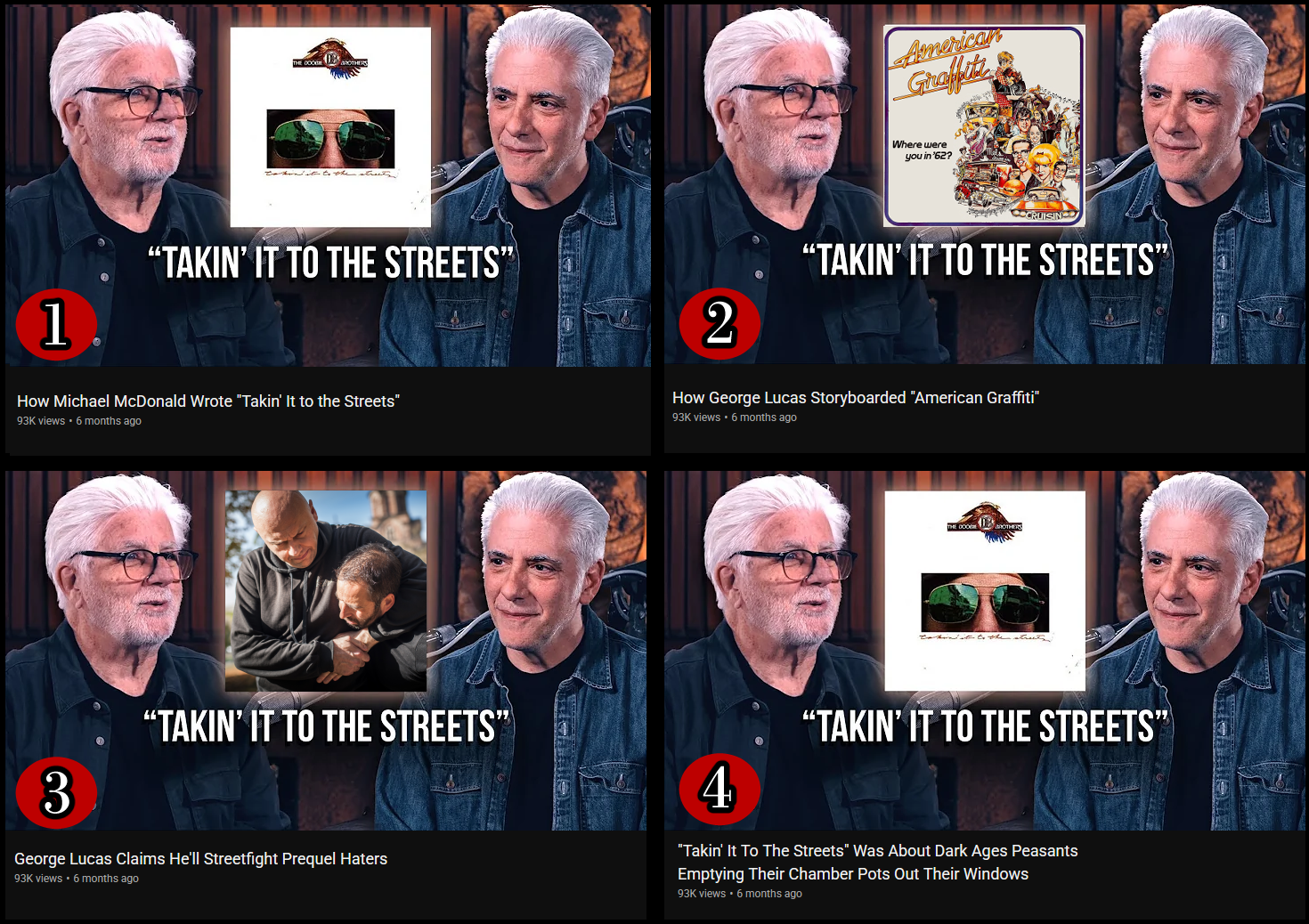

$29.99We don't see enough crafts deals in this roundup. We are part of the ongoing problem, the devaluing of the arts in favor of tech and productivity. NO MORE. From now on this organ is a celebration of creativity and wonder and verve. Unfortunately, I know absolutely nothing about heat pressing, so instead, from now on, this paragraph is a prelude to a completely unrelated quiz where you have to pick the right title for a YouTube thumbnail.

Click here for the answer

It's 3! No, wait, it's 1! Beato!

Top Garden Deal

Gazebos, Pergolas & Canopies Sale at Lowe's

Up to $1,500 offSpeaking as someone who is a natural-born enemy of the sun and all its powers, I stand fully behind this sale. Or perhaps under it. Ahaha. Ah. Use these discounted structures to avoid all of the vicious sun god's superpowers, including UV radiation, water evaporation and condensation (rain), Spectral Blade, and of course, Improved Spectral Blade.

Top PC Deal

Dell 15 13th-Gen. i7 15.6" Laptop w/ 16GB RAM and 1TB SSD

$450This best ever price gets you a 13th-generation i7 CPU, 16GB of speedy RAM, a 1TB M.2 SSD, and a 120Hz display. You might think, surely that isn't sustainable — all those precious metals and plastics and such being sold after mining and shipping and manufacturing at such low prices? To which we say: probably! Get it before the Water Wars.

Top Apparel Deal

Levi's End of Season Sale

Up to 70% off + extra 50% off in-cartThere was a point during my idiot teenage years when I decided that the more abstract math got, the less I cared for it, and so I dropped down to a lower level and never learned how to work with imaginary numbers and the like. And now look at me: reduced to using a calculator to figure out what 50% off these prices would look like, because I stubbornly refuse to add them to my cart to get the answer that way. Luckily, despite what my math teachers used to insist upon, I do in fact always have a calculator with me. That's right: the pleasingly retro Comix C-2735! (My phone got eaten by a shrew.)