5 Deals You Need to Know Today: Up to 60% off Cole Haan at Nordstrom

Men's Cole Haan clothing? At Nordstrom? Up to 60% off? It's all true and those that claim otherwise are liars. Filthy liars. Check out this offer and more in our roundup of the five best deals we found over the last 24 hours.

Top Mainly Shoes But Also Clothes Deal

Cole Haan Men's Sale and Clearance Deals at Nordstrom

Up to 60% offNordstrom has around 40 Cole Haan offerings discounted. This is good. You will not however be permitted to enjoy these savings without enduring some senseless gamery. This is bad. The discounts go as high as up to 60% off. This is good. Deal gremlins have infested the sale and can only be repelled by picking out which of the following single product is real and part of the sale. This is bad. You're nearly free of this insufferable dance though - and yes, you guessed it - this is good. Now guess, goodly.

- Cole Haan Men's 2.ZeroGrand Laser Wing Derby Shoes

- Cole Haan Men's 5.ThreeBillion Flight Sneakers

- Cole Haan Men's 43.FiveFiveTwo Future Funk Leathered Coat

- Cole Haan Men's 1.One Turbo Rocket Socks

Click here for the answer

It was none other than the Cole Haan Men's 2.ZeroGrand Laser Wing Derby Shoes, knocked down from $160 to $110. No turbo rocket socks for you.Top Disney Clothing Deal

Amazon Essentials Disney Boys' Hoodie 2-Pack

$8.99Pixar, Marvel, Star Wars, and even gothic fan favorite Nightmare Before Christmas are all present and accounted for in this, the Amazon Essentials Disney Boys' Hoodie 2-Pack. Up to $22 off are the savings and price of shipping is free for Prime folk. Speaking of shipping and more specifically, ships, there's no sign of Monkey Island here, another Disney owned property. I could complain about how they aren't doing anything with it for the dozens of us who care, except there was actually a new Monkey Island game three years ago which saw the return of series creator Ron Gilbert. I ultimately didn't like it very much though, therefore I can in fact complain. Aha! Gotcha.

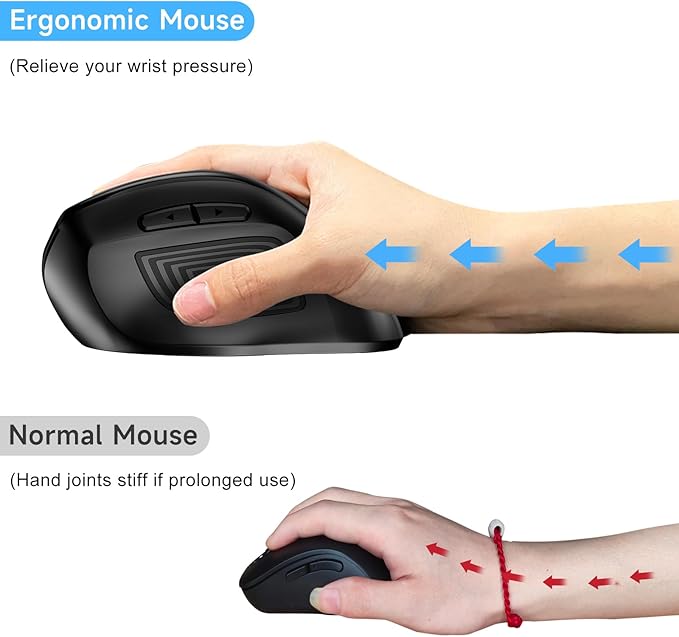

Top Vertimouse Deal

Memzuoix Vertical Wireless Mouse

$8.99Away with easily pronounceable brand names the Memzuoix Vertical Wireless Mouse seems to suggest. In with heavy discounts, at $8.99 and 70% off. Up with verticality it goes on to argue. I've never used an upwards inclined mouse before but they seem nobly to be about comfort first and foremost and eliminating wrist woes. The scientifically reliable arrows explain all.

Top Sale Involving the Word Kalamazoo Deal

Nike Clearance Sale

Up to 44% offSale at Nike, yes up to 44% off is real and true

Sale at Nike, yes thousands of items be discounted for you

Sale at Nike, yes unlike the earlier disappointment there's socks too

Sale at Nike, yes there are somehow multiple places in the US named Kalamazoo

Top Offer Gatecrashed by the Grim Reaper Deal

Lovepop 40" Halloween Pop-Up Card

$7.99I don't know who out there is going around on October 31st every year and giving their buddies Halloween cards but quite frankly I'd be delighted to be on the receiving end of the Lovepop 40" Halloween Pop-Up Card. Look, it's all spooky and three dimensional and reduced from $15 down to $8. Not to steal our deal's thunder but this (sadly not discounted) grim reaper card of the same brand is delightful. He loves that cake. Poison the cake. Live forever. Yes.