What To Know About Walmart's Layaway Program in 2025

Some of us grew up in homes where layaway programs at the start of the year meant seeing presents under the tree come the holidays, and many today still struggle to make purchases for their home or loved ones without some form of assistance. For said people, asking vital questions like, "when does Walmart layaway start?", "what can you put on layaway at Walmart?", or even "does Walmart offer layaway?" can mean the difference between being able to plan for an important expenditure or going without.

For those unfamiliar with the process, layaway first came into favor during the Great Depression. It allowed customers to make a deposit and then make subsequent no-interest payments, receiving the item once paid in full. Retailers liked the program because it offered little risk to them, and even customers with bad credit could find a way to secure whatever purchases they required. If the item was not paid for in full, it would simply be returned to stock, and the customer would receive what payment they had made, possibly minus a fee for the service.

This feature remained a retail staple for decades, and Walmart was no exception, with Walmart layaway sticking around longer than most places. In the 1980s, credit cards became common enough that fewer shoppers were utilizing the program, but it wouldn't be until 2006 that the major retailer would discontinue the year-round layaway Walmart offered its customers. Walmart returned with limited-time layaway in subsequent years following the Great Recession of 2008-2009, but unfortunately for those wondering "does Walmart still have layaway?", Walmart layaway has since been, shall we say, laid to rest.

That said, for those shopping at Walmart, monthly payments are still on the able. Walmart has worked with Affirm for years now to offer short-term financing to qualifying customers. Walmart online layaway in the purest sense may be a thing of the past, but there remains a variety of repayment terms and options for shoppers who need a little assistance with their purchases. For those who require a Walmart layaway online option and feel this switch is entirely negative, there are some benefits to a "buy now, pay later" program.

To start, both layaway at Walmart and "buy now, pay later" programs like Affirm present the consumer with some form of Walmart payment plan. However, "buy now, pay later" programs allow a customer to receive their item right away rather than collecting it at the end of who knows how many Walmart online layaway payments. Of course, those with bad credit might still find it difficult to receive this kind of financing, and some customers aren't going to be happy with the credit check and interest rates that come along with such programs.

Unfortunately for those who were hoping that the answer to "does Walmart have layaway?" would be a firm "yes", the reality is that Affirm is likely Walmart's path forward for the foreseeable future. This partnership has already survived the economic woes of the past few years, having been forged back in 2019, and if these Walmart payment plans could weather that storm, its unlikely that the retailer would consider other avenues unless something drastic comes along to shift corporate policy. So for today's consumer, questions like, "does Walmart do layaway?" or "is Walmart doing layway this year?" would be better off traded in for questions like, "does Walmart do payment plans?" or "can I split payment on Walmart online?" Love it or hate it, we all have to live with it as the world marches onward.

Fortunately, you don't have to navigate these new(ish) policies alone. The layaway Walmart once offered is gone, but Affirm stands ready to take its place, helping customers secure higher-cost purchases without having to pony up the entire amount up front. This service allows you to submit your purchase amount and set what kind of payment plan you want, and Affirm then matches you with a loan based on those terms.

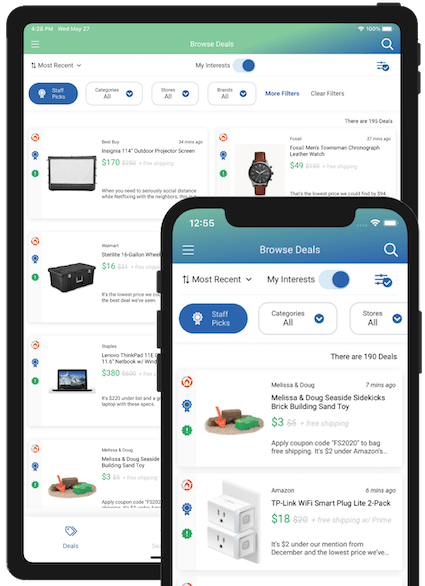

Download Our App Today To Start Saving

The DealNews app lets you skip all the discount duds that flood the internet every day, and instead discover the best deals in one convenient place. Our shopping experts sort through thousands of sales and grab only the very best ones to put into our app. If you ever wished you had a personal shopper that told you what to buy and how to get it on sale, then DealNews is the free app you've been waiting for.

What should I know about Affirm?

Affirm is a "buy now, pay later" program among several others, which enables consumers to make discretionary purchases, especially online, without requiring the full purchase amount at the time of purchase. While shopping at Walmart, split payment options of three to 24 months are available, with interest rates varying based on the terms. Note that most similar services do not offer the potential lengthy term that Affirm can offer, and for those who require a significant repayment period, this service can be a very attractive one.

APR can be as little as 0% for select Walmart items but may be as high as 36%. A down payment may also be required. While there are no service fees or cancellation fees, partial or late payments may impact your credit score or ability to secure new loans with Affirm in the future. Even if you aren't having to pay for the full purchase right away, you still need to be realistic about what terms you can manage to avoid any financial fallout.

To use this type of Walmart payment plan, you'll select an eligible item, apply to the service, select your terms, and then either check out online or present your barcode to a sales associate if shopping locally. From there, you'll continue to make payments until you have fulfilled the terms of your new loan. Many items are eligible so long as they range from $144 - $4,000, including tax. Eligible categories include:

- Home

- Apparel

- Entertainment

- Automotive

- Lawn and garden

- Sporting goods

- Jewelry

- Toys

- Durable baby items

- Select medical devices

- Vision center purchases

Ineligible categories include the following:

- Alcohol and tobacco

- Gasoline

- Groceries

- Consumable baby items

- Health, wellness and personal care purchases

- Consumable pet items

- Weapons

- Wireless service plans

- Gift cards

- Money services

- Photo services

Can I pay off my purchase early?

Absolutely, when you shop at Walmart, split payments can mean paying during specific pay periods for only the required amount, but you can also pay off the entire amount earlier if you wish. There is no penalty for choosing to finish your Walmart payment plan ahead of time.

How do I make my payments?

Affirm will send you email and text reminders before your next payment is due, and you can either make or schedule payments at Affirm's website or in the Affirm app.

Does checking my eligibility affect my credit score?

No, checking your eligibility does not affect your credit score. However, if you make late or partial payments, this may negatively impact your credit score. Signing up with Affirm and completing a loan may affect your credit score, and this could help you build credit over time if that is your goal.

Remember that your credit score is only one important factor when Affirm is determining your eligibility for a loan and your interest rate. It will also look at your payment history with Affirm and the length of time that you have used the service.

Can I return an item I bought with Affirm?

Yes, even items purchased at Walmart with monthly payments are eligible for return. You'll receive the purchase amount in full, but you will lose any interest you paid over the course of the loan. It can take up to an additional three to ten business days to update your account after Affirm receives your refund from Walmart.

Do I need a mobile number to use Affirm?

Yes, you will need to have a mobile phone number from the U.S. or U.S. territories to use Affirm. Affirm uses this information to verify your account and during any account activity.

What else should I consider when shopping at Walmart?

While it can be convenient to use "buy now, pay later" programs, you shouldn't treat them any differently than you would a credit card. If you lean so much on them that you exceed your budget, you can run into credit issues down the line just the same as if you had used an ordinary credit card beyond your limit to pay. You should also consider the value of using such a service at all. While you may enjoy getting your item without a large price tag right out of the gate, choosing a lengthy term with high APR could have you paying so much that your purchase isn't even a very good price any more.

At the end of the day, it's likely best to use Affirm for the same circumstances you would have used the layaway Walmart used to offer. It can be helpful for making larger purchases over time when your budget just won't allow for them all at once, but it shouldn't become a free-for-all where you feel you can shop consequence-free for a bunch of splurges you don't really need. These kinds of "buy now, pay later" programs trade the relatively risk-free payment model Walmart's layaway program used to offer for the convenience of getting your purchase immediately, and that kind of instant gratification can sometimes be more than you've bargained for.

Remember that very few purchases that you make via Affirm will truly be cost-free the way Walmart's layaway online would have been. For nearly everything, you will be stuck paying interest, and those rates can add up significantly over time. Even at 10%, which is the lowest you will typically find on your Walmart purchases, that item is going to accrue enough interest that you might be left wondering what else you could have purchased with that money still in your account. Think of Affirm instead as a way to handle the curveballs life throws at you, a lifeline for expensive things you need now but can't afford presently.

Advertiser Disclosure

DealNews has financial relationships with the credit card issuers mentioned on our site, and DealNews receives compensation if consumers choose to apply for these by clicking links in our content and ultimately sign up for these specific cards. This compensation has no impact or influence on where or how the cards appear on dealnews.com. DealNews does not include all card companies or all card offers available in the marketplace.

UGC Disclosure

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Bank Disclaimer

This content is not provided or commissioned by the Bank Advertiser. Opinions expressed here are author's alone, not those of the Bank Advertiser, and have not been reviewed, approved or otherwise endorsed by the Bank Advertiser. This site may be compensated through the Bank Advertiser Affiliate Program.

While layaway at Walmart may be a thing of the past, we hope that you learned more about what financing options are available for customers today. For more information about Walmart and deals from around the web, stay tuned with us here at DealNews where we put over 25 years of experience to work every day. Not only do we cover trending sales and the lowest prices on popular items, but you can also set a deal alert to track down exactly what you're looking for. Once your alert is set, you'll receive a notification if we find it on offer somewhere. You can also receive a summary of the best deals by signing up for our DealNews Select newsletter. Finally, you can sign into your account and personalize your experience to see the deals you want to see.

- Walmart and Apple Pay might not be a match, but there are reasons for that. Check out our guide is here to help you learn more.

- What does a Walmart Plus membership get you in 2025? Our experts break down the benefits and cons of the membership program in this overview.

- Read our expert's analysis of the Walmart layaway program for a better understanding of its current features in 2025.

- Learn what senior citizen discounts are available starting at age 50 with our 2025 guide.

Sign In or Register