Does Target Take Apple Pay? What To Know in 2025

Target stores are beloved by shoppers all over the United States for a variety of reasons, from affordability to access to formerly direct-to-consumer brands and much more. Consumers also know they can look to Target to utilize the latest technological advances in shopping, even if they don't adopt them right away. Read on for our complete guide on if you can use Apple Pay at Target in 2025, how to use Apple Pay at Target, and what to expect going forward.

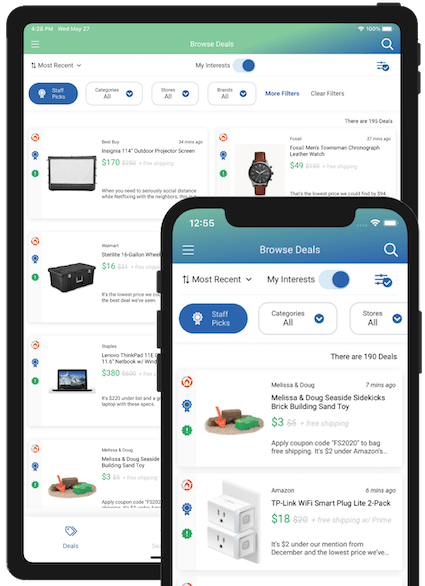

Download Our App Today To Start Saving

The DealNews app lets you skip all the discount duds that flood the internet every day, and instead discover the best deals in one convenient place. Our shopping experts sort through thousands of sales and grab only the very best ones to put into our app. If you ever wished you had a personal shopper that told you what to buy and how to get it on sale, then DealNews is the free app you've been waiting for.

Top Target Deals

Target Top Deals

Up to 60% offFind the top discounts from Target in this sale, which features savings across categories like home, apparel, electronics, toys, and more.

Target Circle Deals

Up to 20% offBrowse and clip a variety of digital coupons to help you save on practical purchases as well as the items you want to buy when you need to treat yourself. You'll find savings in categories like baby, beauty, food, health, home, pets, tech, and more, as well as special promotions such as earning Target gift cards on select purchases and buy more and save specials.

Target Clearance Deals

Up to 50% offStock up on all your Target faves before they're gone! Target Clearance Deals are where you'll find deep discounts on everything from seasonal products to collabs that have ended, out-of-season apparel to discontinued products and so much more.

What is Apple Pay?

Apple Pay is the iPhone user's answer to mobile payments and digital wallet needs. Like Samsung Pay and Google Pay, it's meant to be more convenient and secure than carrying around a bunch of cards and cash. Even better, Apple Pay users can make those secure transactions using a variety of Apple devices including iPhones, Apple Watches, iPads, and MacBooks.

So how does Apple Pay work? First-time users will need to set up their payment options by adding their preferred credit or debit cards (or both) to their Apple Wallet. When you're ready to pay, you can double-click and tap to pull up the option, then hover your Apple device near the payment console. It utilizes Near Field Communication (NFC) tech to facilitate contactless payments at supported in-store retailers. Online stores don't need NFC to use the payment options; instead, if it's supported, it'll be one of the payment options listed during checkout. And since Apple Wallet is available across all your Apple devices, it's simple to place an order whether you're shopping on your iPhone, iPad, or MacBook without having to add new information every time. You can also add extra security to your payment options by requiring authentication via things like Touch ID, Face ID, or your passcode.

Why Are Mobile Payment Methods Important?

Apple Pay is just one mobile payment option, but in general mobile payments are valued by consumers for their added security, convenience, and speed when shopping. With options like Apple Pay, shoppers don't have to worry about carrying physical wallets, cards, and cash, unless they prefer to have some backup options on hand just in case. (This is a good idea just in case a system is down, for example.)

Most consumers today carry a smartphone of some kind and rely on the tech as well as its connection to digital services. Because of this, mobile payments have become an option that customers expect to be able to utilize wherever they shop and increasing a demand for the technology from large chains as well as indie stores. By offering these options to customers, retailers increase the likelihood of positive interactions for customers which can lead to stronger loyalty and satisfaction.

Target's Significance in the Retail Industry

Target is one of the largest big-box store chains in the United States, with more than 1,900 locations across the country and Target salvage stores growing in popularity. It also has a solid online presence, offering customers the ability to shop online and pick up in-store, as well as shop various third-party sellers and have items shipped directly to their homes. Target has a strong, loyal customer base that allows them to compete with the likes of Walmart and even online giants such as Amazon. Adopting features like mobile payments including Apple Pay ensures that Target can continue to compete with other big retailers during the busiest holidays in addition to year-round and work to make these sorts of payment options even more streamlined and widely available.

Target's Previous Apple Pay Policy

When Apple Pay was first introduced in 2014, Target wasn't keen to accept it as a method of payment right away. Citing concerns over security as well as fees for processing transactions via Apple Pay, the retailer held off implementing it at the time. Instead, Target focused on building its own wallet into its app to fulfill customers' mobile payment needs. Although Target was one of the major retailers to turn Apple Pay down initially, they were far from the only ones; Best Buy and Walmart also refused to support the method, as well as many restaurants and other retailers.

Timeline of Target's Adoption of Apple Pay

- 2008: Target launches mobile app

- 2014: Apple Pay officially introduced

- 2015: Target acknowledges Apple Pay, but isn't ready to support yet

- 2017: Target notes no support for NFC payment options

- 2017: Target launches digital wallet within mobile app

- 2019: Target begins accepting Apple Pay in-store

Can You Use Apple Pay at Target?

While Target didn't begin accepting Apple Pay in stores until 2019, the payment method was an option via Target's website and app before then. Now, Apple Pay is widely accepted at Target whether you're shopping in stores or prefer to shop online. Either way, Apple Pay can be used in stores, online, or via the app. As Target will also accept other NFC payment methods in-store, Apple Pay may have been simply included because it uses the same technology. But when shopping on Target.com and through the Target app, Apple Pay is specifically listed as the only payment method of this type; Google Pay and Samsung Pay are notably missing from payment options online or via the Target app, but they are accepted in-store.

Given that Walmart still doesn't accept NFC payments of any kind, it stands to reason that Target wanted to join the crowd and provide more payment options to customers in an effort to provide a more pleasant experience. It also doesn't hurt that since Walmart is their primary competitor, this move gives Target an inherent boost and can help sway customers who may be on the fence.

Market Trends in Mobile Payment Adoption

While mobile payments have been around for decades at this point -- the first mobile payment has been documented as occurring in 1997 via a vending machine and SMS messaging. Mobile payments became a huge part of life in Japan in the 2000s and since then it's only grown to be more popular across the world. Now, many retailers utilize the convenience of mobile devices to allow customers to pay however they prefer.

In 2021, mobile payments accounted for 71% of digital transactions, but that number is slated to grow to 79% by 2025. Part of the rapid growth of this technology is likely due to the COVID-19 pandemic, which helped to spur mobile payments in the United States, with 29% of shoppers using the method in 2019 vs 43% in 2021. Now, more than half (53%) of those residing in the United states claim to use digital wallets more than traditional payment methods. Given that 39% of consumers in the U.S. claim they'd use mobile payments more if they were widely available, this could have certainly contributed to Target finally taking the plunge and allowing NFC payments in stores.

Competitors' Practices

One of Target's largest competitors, Walmart, still doesn't accept Apple Pay even in 2025 . In fact, it doesn't utilize NFC technology to accept any "tap-to-pay" options. Instead, Walmart has its own method called Walmart Pay, which allows shoppers to pay via the Walmart app as long as they save something like a debit, credit, or gift card to their account. Then during the checkout process, they scan a QR code to pay that way.

Meanwhile, Amazon does allow Apple Pay — in some cases. Apple Pay can be used for certain transactions, but when it comes to third-party sellers, it's an option that they have to enable. Therefore you may not be able to use Apple Pay for all your Amazon purchases; even so, if you have an Apple Card, that's a relatively simple workaround you can use instead.

Tech Advancements and Security Concerns

While NFC currently leans hard into the "near" part of the near field communication, the good news is that advancements could widen the capable range in the coming years. Right now in order to use an NFC functionality, shoppers have to have their phones about 5mm away from the console, but the goal is to widen that field to 30mm. This means that the whole process could be much easier, as shoppers won't have to try to find the exact point of contact needed to make the payment go through. The NFC Forum is planning to make developments that will allow NFC to be used for easier point-of-sale in general, and could help retailers who haven't yet adopted the tech more likely to finally buy in.

Even with all its advancements and advantages, the use of NFC does present some security concerns. There are several examples of things that bad actors could do, in theory, including data tampering, eavesdropping, malware, cloning, skimming, and more. However, it's important to note that with the NFC field being so small, the hacker would have to know exactly where your phone is and be able to get very close (remember, within 5mm) to their target in order to try to perform many of these. It doesn't mean these risks are impossible, but it does make them less likely than other security risks.

Given that Apple tends to prioritize security with many of its devices and services, and Apple Pay is no different. While optional, customers can use two factor authentication to approve purchases by using a passcode and things like biometric scanners for fingertips or even Face ID. While an added step, this only improves the security of using NFC payment methods like Apple Pay.

Advantages of Accepting Apple Pay

It's more convenient. It should come as no surprise that using a digital payment method like Apple Pay is more convenient than having to carry cash and cards. By providing shoppers with multiple payment options, they can choose whichever they'd like, but allowing for the use of these convenient options increases the likelihood of customers having a smoother experience and returning in the future.

It's expected. Thanks to the widespread adoption of NFC, most shoppers probably expect options like Apple Pay to be available at all major retailers at least. Some indie shops may be reluctant to implement the technology, but if you're visiting a store that's located all across the country, there's a good chance you expect to be able to pay using your preferred method, whether that's a tap-to-pay, credit card, or cash.

Potentially higher sales for retailers. It may not be immediately clear how allowing NFC payment methods can lead to potentially higher sales for stores, but the truth is that if a shopper doesn't have to worry about having an accurate amount of cash on hand or ensuring they have their wallet with them, they won't have to stress about how much they're spending. This can lead to shoppers making more impulse purchases or at least shopping for items that they need but may have forgotten about until they started shopping.

Potentially more loyal customers. Simply put, the more options a shopper has, the more likely they are to return to the store offering those options. Whether it's product variety or payment methods, when a shopper can find what they're looking for at prices they agree with and shop the way they want, they'll choose that retailer more often than ones that don't provide the same level of customization.

Disadvantages or Challenges of Accepting Apple Pay

Fees to use the tech. The good news is that because Apple Pay is a digital wallet, the customer has to set it up with their preferred debit or credit card in order to use it. Because of that, Apple Pay doesn't have added fees for businesses or customers; instead, the only fees a business has to worry about is whatever processing fee they already have for credit cards.

It can be expensive to implement. Target has already implemented the technology to allow NFC payments so this is less of a concern now. While it was an investment initially, by now Target has likely recouped the costs of doing so.

It comes with security concerns. Like other types of technology, NFC and therefore Apple Pay come with some security concerns. But Apple Pay also has extra security features in place as well as some that can be enabled to provide shoppers with peace of mind around the service.

The potential for resistance from consumers. Given that recent surveys have indicated 39% of consumers say they would use mobile payments more frequently if it were supported by more stores, the chance for resistance from customers seems pretty low.

What Do Customers Prefer?

There are a lot of different payment options available in the United States and some consumers may still prefer utilizing methods like cash in order to keep their spending under control. But the truth is that Apple Pay absolutely dominates the mobile payment market in the U.S. It has the largest transaction volume of any mobile payment service in the U.S. with a projected 55.8 million consumers expected to use it last year. Since younger consumers are more readily adopting mobile payment methods, this preference is likely to only increase as time goes on. Gen Z online shoppers are already far more likely — 120% in fact — to use Apple Pay than millennials, so if the elements of it continue to improve, there's no reason to expect a step back. More likely, consumers will continue to use mobile payment methods and adopt those that are proven and widely accepted at retailers across the country.

Does Target Take Apple Pay?

Yes, Target takes Apple Pay both in-store and online as a valid payment method.

Does Target Self Checkout Take Apple Pay?

Yes, Target self checkouts have the ability to accept Apple Pay due to the integration of NFC technology for payments.

Is There A Workaround In-Store?

If you're wondering how to use Apple Pay at Target, the good news is that Target accepts Apple Pay in-stores now. But if you don't want to utilize the tap-to-pay technology, you can add an Apple Card to your Target wallet if you have one. And then you can use the Target app to pay for your purchases when shopping in-store rather than worrying about having to pinpoint the exact spot for NFC methods.

What Other Payment Types Does Target Accept Both via App and In-Store?

When shopping on Target.com or via the Target app, the following payment methods are accepted:

- Target RedCard in all its forms

- Third-party credit cards, including American Express, Discover/Novus, Mastercard, Visa, and more

- Third-party debit cards, though they must be connected to either Visa or Mastercard and processed as a credit card

- Target GiftCards, Target eGiftCards, and mobile Target GiftCards

- Third-party installment plans (also known as buy now, pay later) like Affirm, Sezzle, PayPal Pay in 4, Afterpay, Klarna, and Zip

- Third-party gift cards from American Express, Discover, Visa, and Mastercard

- PayPal, although PayPal cannot be used to pay for items sold by Target Plus Partners

- Apple Pay

EBT card payments can also be used, specifically the SNAP EBT payment online. However, cash EBT payment is not currently accepted and SNAP EBT can't be used to pay for purchases from Target Plus Partners.

As for shopping in-store, customers have even more payment options. The following can be used in Target stores to pay for purchases:

- Cash

- Target RedCard in all its forms

- Target app

- Target Temporary Slips

- Third-party credit cards including Visa, Mastercard, Discover/Novus, American Express, credit cards from foreign banks, Diner's Club International, and FSA/HSA where applicable

- Debit/ATM and EBT cards

- Contactless pay using Target Mastercard or any other approved third-party credit card designed for contactless payment

- Gift Cards, including Target GiftCards, Merchandise Return Cards, and Prepaid Gift Cards with a Visa, Mastercard, Discover, or American Express logo

- Gift certificates

- Merchandise voucher

- Multiple payment methods sales

- Personal checks

- Rebate checks

- WIC Program (in authorized stores only)

- Mobile Payments such as Apple Pay, Google Pay, Samsung Pay, or any contactless digital wallet

- Alipay in authorized stores only

- Campus Cash in authorized stores only

Online vs In-Store Shopping Comparison

Shopping at Target whether online or in-store is going to be fairly similar for the most part. Online shopping at Target.com will have a larger selection of items overall due to third-party sellers (also known as Target Plus Partners). But shopping in-store also has its own benefits, like a better selection at Bullseye's Playground for super cute and affordable seasonal picks.

Ultimately the deals are going to be largely the same whether you're shopping online or in-store unless there's a product that's only available at one and not the other. Really it comes down to how you prefer to shop and whether you want to pick your items yourself, or if you trust a Target associate to do your shopping for you. You can utilize one or the other but Target is also a great option if you want to order online and pick up in-store so that you get your items sooner and don't have to worry about placing minimum orders or waiting for your order to be delivered.

What Else Should I Consider When Shopping at Target?

It can be easy to fill your cart with more than you intended on a Target trip, whether you're shopping online or in-person. But there are a few things to keep in mind to ensure you get the best price on your next Target run.

Set up deal alerts. If you're shopping for something in particular, consider joining DealNews and setting up an alert for the products you're interested in. Then, when we list a deal that fits your parameters, you'll receive a notification and you can jump on it before it sells out.

Sign up for newsletters. While you're joining DealNews, why not sign up for our newsletters? That way you'll receive our best highlights every day to streamline your search for the greatest bargains out there.

Streamline your online shopping. Whether you're shopping at Target or another online retailer, you can personalize your DealNews profile. That means you'll only see the deals and categories that are most interesting to you, so you don't have to wade through a bunch of items you aren't planning to buy.

Download the DealNews app. Take your personalized experience with you wherever you go and never miss another deal! When you download the DealNews app, you can be sure to take advantage of great savings any time of day.

Call ahead. Some methods of payment, such as Alipay and Campus Cash, are only available at authorized Target stores. If you want to use either of these (or another niche payment) consider calling your store ahead of time to make sure they can accept your preferred method.

Get a Target RedCard. If you have decent credit, you may want to apply for a Target RedCard. There are multiple options, so you can apply for a credit card that can strictly be used at Target or a Target Mastercard that can be used elsewhere. You can also apply for a debit card or open a reloadable RedCard account if that suits your needs better. You'll earn rewards when you use your card and as a bonus you'll save 5% on most purchases at Target, among other perks.

Target has a lot to offer shoppers in 2025 and using Apple Pay to pay for purchases both online and in-store is just one of the many perks. Even better, as technology continues to improve, the advancements of NFC could make the process of mobile payment methods even smoother than it is now, which will result in a more enjoyable shopping experience for Target shoppers.

- Walmart and Apple Pay might not be a match, but there are reasons for that. Check out our Walmart Apple Pay guide to learn more.

- Disney is getting ready to hike prices again, so here's what you need to know about the latest Disney Plus price increase . Stay informed to plan your subscription wisely.

- There are tons of different streaming services available now, but Peacock is one of the more affordable options. Check out our guide on how much Peacock costs per month to learn more and save.

- Paramount Plus is one of the few streaming services that still offers a free trial. Check out our breakdown of how much Paramount Plus costs per month in 2025.

Julie's work has been featured on CNBC, GoBankingRates, Kiplinger, Marketwatch, Money, The New York Times, Real Simple, US News, WaPo, WSJ, Yahoo!, and more. She's extolled the virtues of DealNews in interviews with Cheddar TV, GMA, various podcasts, and affiliates across the United States, plus one in Canada.

Sign In or Register