Does Amazon Offer Price Adjustments? Save With The Guarantee Today

Amazon's price adjustment policy has undergone multiple changes over the years, and still remains subject to change. As of 2024, they do not offer price matching, since they constantly compare their prices to competitors' prices, making sure their prices are as low or lower than other retailers. As consumers, however, we know that they're not always successful. We're all here at DealNews to shop around for the best deals — from Amazon or otherwise!

SEE ALSO: 2025's Best Prime Day Deals To Save With, From TVs To Video Doorbells & Security Cameras

Nonetheless, here are a few ways to hack your way to getting the lower price on an item you've already purchased. Before you attempt any of these, make sure the item that has a lower price is the exact same make, model, color, and any other defining characteristics of the item you originally purchased. If only it were as easy as Costco's price match policy, eh?

Top Amazon Deals

Amazon Outlet Overstock Electronics Deals

Up to 60% offSave on thousands of items including headphones, speakers, batteries, cell phone accessories, and much more. We've pictured the Power Strip Tower w/ 6-Foot Power Cord for $20 after clip coupon ($10 off).

Amazon Outlet Clothing Overstock

Deals from $2Shop thousands of styles, including steep discounts on premium brands. We've pictured the Columbia Men's Moisture Control Crew Socks 4-Pair Pack for $17 ($7 off).

Chat Online With an Agent

Since Amazon does not have a guaranteed price adjustment policy, per se, it's worth asking a customer service agent about your issue. They are not required to give you a refund or credit on the difference, but an agent may be willing to help in some way. Tell them how your recent purchase is now available at a lower cost, and you wanted to inquire if a price adjustment would be considered. Your original purchase should be fairly recent — attempting to get a price adjustment on something that you bought over 30 days ago will be a stretch. Amazon is known to have great customer service though, so it's worth a few minutes of your time to chat with them, especially if the price drop was big enough. To contact a live agent to chat, there are a few steps to follow.

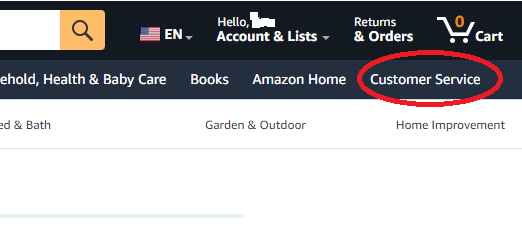

- Once logged into your account, click Customer Service from the top right corner.

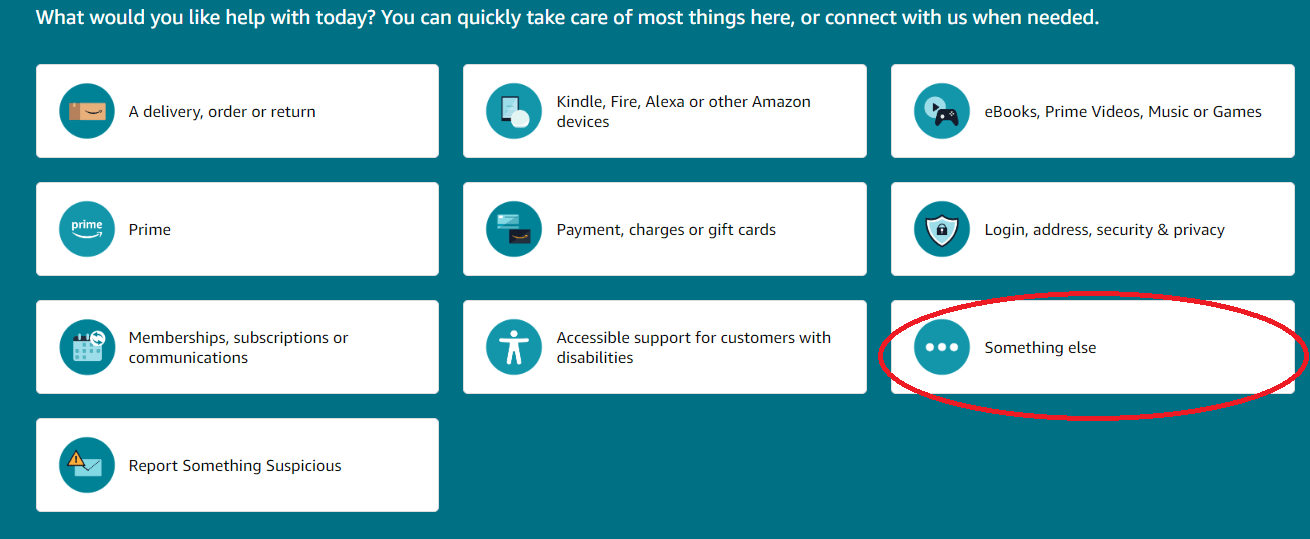

- From the Customer Service home page, select Something Else.

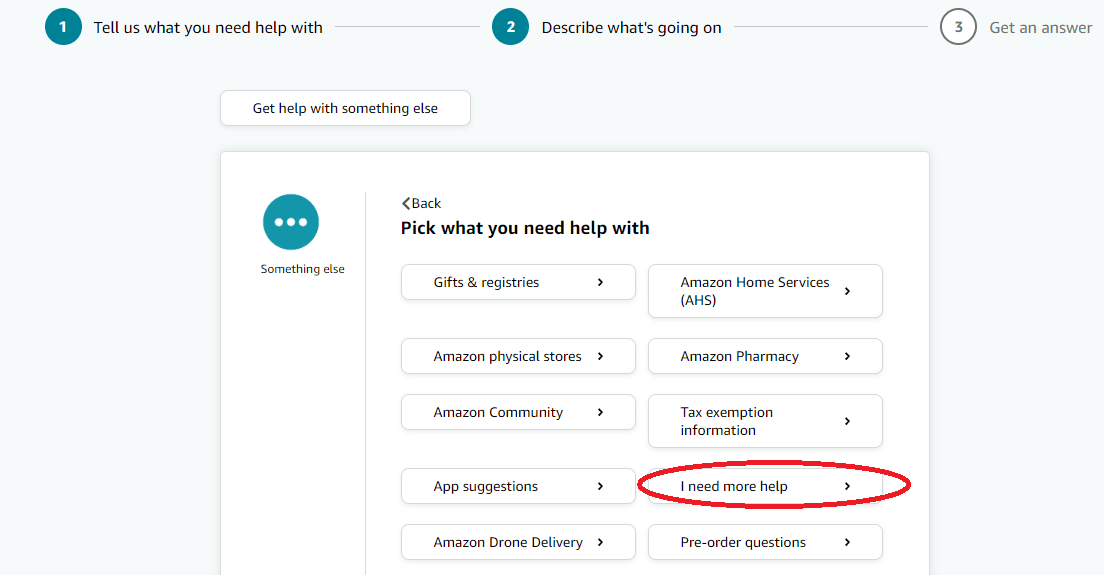

- At the next screen, click "I need more help".

- This will cause a separate window to pop up (make sure to have pop-ups enabled on your web browser), and an agent will join the chat to help you.

Return and Rebuy

If the agent option didn't work, and the item you purchased is still within the return window, we have another tactic for you to try. If you haven't already used the item, and it's still in new, returnable condition, another option is to simply return the unused item and repurchase it at the new lower price. This is only feasible if you haven't already opened the packaging, you don't need the item urgently, and can wait for the lower-priced identical item to be shipped.

You will likely get a refund on your original payment method, and will have to wait for your item to be received by Amazon to get your refund, so make sure to keep this in mind as well. This is a longer process, but if the price difference is significant enough, it can be a viable option. One perk of this option is that most times returns are free, and you will receive a mailing label to return your item, or it can be dropped off to a nearby return-accepting facility like Whole Foods.

What Is Amazon's Tell Us About a Lower Price Feature?

This is not a tool that will help you immediately on any purchases you have already made, but Amazon does have a program on their site to let consumers notify Amazon of a lower price you found elsewhere from another retailer. (There's a button in the feedback section of the product details.) From there, they will convey the feedback to their marketplace sellers. Now, whether this even makes a difference or convinces them to lower or change their prices to match, who knows?

(In case it seems like Amazon's nebulous price match policies are unique, it's worth remembering that Walmart's price matching is not really a straightforward process either, with a lot of stipulations attached. Price matching can be a real hassle of qualifications and exceptions, so it's great when stores like Target and Home Depot have policies that are easier to figure out, and obviously the aforementioned Costco is right up there with them. But it all depends on the individual store.)

What Can't Be Returned to Amazon?

Amazon does have limitations to its return policy — here is a list of items that are not eligible for returns.

- Hazardous materials

- Electronics

- Digital goods

- Gift cards and prepaid cards

- Amazon bulk liquidations

- Any items lacking a serial number or UPC

- Products from Amazon Fresh and Grocery

- Items subject to special shipping restrictions

- Live insects and creatures

- Select jewelry items

- Certain health and personal care items

- Personalized products

Amazon Trade-In Program

This program may not be well known but it's another way to save some money on new items you may want to purchase! The Amazon Trade-In program allows customers to trade in their old and gently used items for Amazon.com gift cards to use toward future purchases. You must have an active Amazon account to participate, but you don't need to have a Prime membership. Eligible items include certain Amazon devices, electronics, video games, and more. With Prime Day deals on the way, some Amazon gift card credit would be a great way to score some new stuff while paying less. If you have an eligible item, you have 45 days to send your item to Amazon. Once they receive and process your trade in, the gift card will be applied to your account.

To qualify for a trade-in, your items must correspond precisely with the version listed on the Amazon product page. If your item is not found within their trade-in store, it means they currently do not have a trade-in offer for it. Their list of trade-in eligible products are frequently updated, so be sure to check back periodically. If your item is not listed but you still want to get rid of it, you have the option to recycle your device via the Amazon Recycling Program. Details on safely and responsibly recycling your electronics with Amazon can be found in the Recycling Your Electronics customer service page.

What Are Lightning Deals?

Amazon's Lightning Deals are time-sensitive promotions that you can find throughout the site, specifically on the Today's Deals or Prime Day page. These deals are limited to one per customer and remain available until either the promotion period ends or all deals are claimed. You should act quickly and complete your order to claim the deal, since there are a limited amount of items for each deal!

When a Lightning deal is available, you'll see:

- The item featured and available to purchase

- Any available variations (different colors, size, or other elements)

- Promotional price and discount amount

- The status bar showing the percentage of deals already claimed

- The timer showing how long the promotional price has left

What Are Some Benefits of Amazon Prime Membership?

- Free 2-day or quicker shipping for online purchases

- Streaming services

- Shopping discounts at Amazon family of companies, like Whole Foods, Amazon Fresh, and more

- Two adults living in the same household can share a membership across separate accounts and both get the Prime benefits

- Amazon Photo gives you secure unlimited photo storage and enhanced search and organization features in Amazon Drive for you and the members of your Family Vault

- Prime Reading lets you borrow books, magazines, and other materials from the Prime Reading catalog. You can then read them on your Fire tablet, Kindle e-reader, or Kindle app for iPhone or Android

You don't get to be as enormous and successful as Amazon without doing your best to keep customers satisfied. So even if they don't have a specific price match policy, they are very customer-focused, so it's worth a shot to try some of the methods above.

Consider signing up for the DealNews Select newsletter, which drops a bunch of handpicked hottest deals into your inbox every weekday. You can also set a deal alert for products you're interested in and receive a notification when they go on sale.

Advertiser Disclosure

DealNews has financial relationships with the credit card issuers mentioned on our site, and DealNews receives compensation if consumers choose to apply for these by clicking links in our content and ultimately sign up for these specific cards. This compensation has no impact or influence on where or how the cards appear on dealnews.com. DealNews does not include all card companies or all card offers available in the marketplace.

UGC Disclosure

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Bank Disclaimer

This content is not provided or commissioned by the Bank Advertiser. Opinions expressed here are author's alone, not those of the Bank Advertiser, and have not been reviewed, approved or otherwise endorsed by the Bank Advertiser. This site may be compensated through the Bank Advertiser Affiliate Program.

- Discover the perks of Amazon Prime membership, from free shipping to streaming: Amazon Membership Cost. Make the most of your subscription with these tips.

- Amazon Prime usually costs $14.99 a month or $139 a year, but you can save on the service. Our tips for securing an Amazon Prime membership discount have you covered.

- While Amazon doesn't offer a year-round military discount, there are still ways to save: Amazon Military Discount. Learn how to make the most of these savings.

- Nobody wants to have to worry about missing packages, but delivery issues happen. Learn what to do if your Amazon package never arrived and how to avoid future mishaps.

- There are tons of different streaming services available now, but Peacock is one of the more affordable options. Check out our guide on how much Peacock subscriptions cost to learn more and save.

Sign In or Register