20% Off TurboTax Discount Codes & Coupons | February 2026

Let's be honest, taxes are probably the last thing on your mind in December. With holiday planning in full swing, the thought of W-2s and deductions feels a world away. But hear us out: getting a head start on tax prep is one of the smartest money moves you can make. While everyone else is scrambling in April, you can be relaxing, confident that you've already locked in the best price and avoided the last-minute stress. This guide is your secret weapon for finding every possible TurboTax discount and making this tax season the easiest one yet.

Now, when it comes to TurboTax promo codes, things work a little differently. You won't typically find a generic coupon to copy and paste at checkout. Instead, the best TurboTax savings are unlocked through special partner links, referral programs, and exclusive discounts for groups like military members, students, and first responders. For the 2026 tax season, TurboTax is also making the filing process even smoother with major enhancements to its AI-powered Intuit Assist, designed to provide smarter, real-time answers as you go.

Top TurboTax Discount Codes

Intuit TurboTax Software Deals

Up to 31% offGet prepared for tax season now and pick up the best TurboTax solution for your needs in this sale. You'll save up to 31% off and can choose from Deluxe, Premier, Home & Business, and more options to make sure you get exactly what you need.

Intuit TurboTax Deluxe Federal Tax Software

31% offYou'll save $22 on the TurboTax Deluxe Federal software with this deal. It's ideal for those that own a home, have charitable donations, high medical expenses, or only need to file a Federal tax return. Note that this item is non-returnable and non-refundable.

Intuit TurboTax Deluxe Federal & State Tax Software

30% offPick up this software now and have everything you need to file your 2025 taxes. You'll save $24 on this PC/Mac download with this deal and have a digital code delivered shortly after completing your order. Note that this item is non-returnable and non-refundable.

Intuit TurboTax Premier Federal & State Tax Software

28% offGrab the TurboTax Premier federal and state tax software download and you'll save $32 with this deal. This version of the software is good for those that are self-employed, independent contractors, freelancers, small business owners, sole proprietors, or consultants. You'll receive a digital code shortly after completing your purchase. Note that this product is non-returnable and non-refundable.

Intuit TurboTax Home & Business Federal & State Tax Software

26% offYou'll save $34 with this deal on the TurboTax Home & Business software. It's ideal for those who may have sold stock, bonds, mutual funds, or employee stock, or if you own rental property or are a trust beneficiary. Note that this item is non-returnable and non-refundable.

TurboTax Business Federal Tax Software

24% offSave $46 on the TurboTax Business federal software with this deal. This tier of the software is recommended for those that have a partnership, own an S or C Corp, multi-member LLC, manage a trust or estate, or just need to file separate tax returns for your business. Note that this item is non-returnable and non-refundable.

TurboTax Referral Program

$25 gift card w/ eligible referralsRefer your friends to TurboTax and they'll save 20% on online federal products. Plus, you'll get a $25 gift card for each friend that uses your link to file. You'll need to enter your email address in order to get a link and then you can share that with your friends to use for them to receive their discount (and for you to get credit for your gift cards!). Note that this offer is valid through October 15, 2026.

TurboTax Software Military Discount

Free federal and state taxes filingSelect military members can get your federal and state taxes filed for free when you do your own taxes. This offer is valid for active duty and reservists of an enlisted rank (E-1 through E-9) with a W2 from DFAS. Note that this offer excludes National Guard members as well as TurboTax Live products. The discount will be applied when you are ready to file.

TurboTax Student Discount

20% offYou'll need to verify your status through ID.me to receive the discount, but when you do you'll get 20% off TurboTax federal products. Note that the discount does not apply to state products and actual prices are determined at the time of print or e-file. This offer isn't valid for Intuit TurboTax Verified Pros.

TurboTax Teacher Discount

20% offYou'll need to verify your status through ID.me to receive the discount, but when you do you'll get 20% off TurboTax federal products. Note that the discount does not apply to state products and actual prices are determined at the time of print or e-file. This offer isn't valid for Intuit TurboTax Verified Pros.

TurboTax Software Deals at Best Buy

From $69.99Shop TurboTax software at Best Buy and get what you need now to be prepared for the upcoming tax season. You'll find options for federal and state filing with a range of tiers to choose from to make sure you get the right option for your needs. You'll receive your product via digital delivery.

TurboTax Software Deals at Staples

From $69.99Shop TurboTax software now and you'll be ready to go for the upcoming tax season. There are options for both federal and state filings, so you can get exactly what you need. Prices start at just $69.99 and you'll receive your product via digital delivery.

What TurboTax Discount Codes Are Available This December?

When you're hunting for TurboTax deals, the first thing to know is that they play the game a little differently. You're not going to find a long list of traditional promo codes to copy and paste. However, you don't need a manual TurboTax offer code to get the best price. Instead, the savings are unlocked through special partner links, exclusive offers for certain professions, and by knowing the right time to file. Since it's December, you're in the perfect position to learn the landscape and plan your attack for when the best deals drop early next year.

Partner and Membership Discounts

This is where many of the best and most reliable discounts are found. TurboTax teams up with hundreds of companies to offer savings to their members and customers. The key is to always start your filing process by clicking through the link on your partner's website to ensure the discount is automatically applied.

- Financial Institutions: Many banks and credit unions offer up to 20% off or cash back on TurboTax. Check the member deals or offers section of your online account with providers like Bank of America, Navy Federal Credit Union (NFCU), and BECU.

- Membership Groups: Your subscriptions can pay off. Organizations like AAA and Costco frequently have exclusive TurboTax discounts available for their members in their online portals.

- Cashback Sites: Don't sleep on this insider trick for stacking savings. Start your purchase through a cashback portal like Rakuten or an airline shopping program like AAdvantage eShopping to get a percentage of your purchase back.

Community and Professional Discounts

TurboTax offers significant savings as a thank you to people in certain communities and professions. These discounts are typically verified through a service called ID.me to confirm your status.

- Military Discount: This is the best deal available, period. Active duty and reserve military personnel (enlisted E-1 through E-9) can file both their federal and state taxes for free using the TurboTax Online versions.

- Students: Students can often get a 20% discount on TurboTax software, which is specifically designed to help find and maximize education-related credits and deductions.

- First Responders, Teachers, and Medical Providers: Verified nurses, government employees, teachers, and first responders are often eligible for discounts of up to 20% off.

Specific Deals and Free Filing Options

Beyond partnerships and professional status, there are a couple of other key ways to get a great deal on your tax prep.

- Refer-a-Friend Program: If you're new to TurboTax, this is an easy win. Use a friend's referral link, and you'll get 20% off your federal tax product. As a thank you, your friend will receive a $25 gift card.

- TurboTax Free Edition: The ultimate discount is paying nothing at all. If you have a simple tax return (Form 1040 only with limited credits), you may be one of the 37% of taxpayers who qualify to file both federal and state taxes for free. It's always worth checking your eligibility before you pay.

Maximizing Your Savings: Insider Tips

As deal hunters, we know a few extra tricks to ensure you're getting the absolute lowest price possible.

- File Early for the Best Price: Mark your calendar. The biggest public discounts from TurboTax, often up to 25% off, are typically offered to early filers in January and February. Prices creep up as the April deadline gets closer.

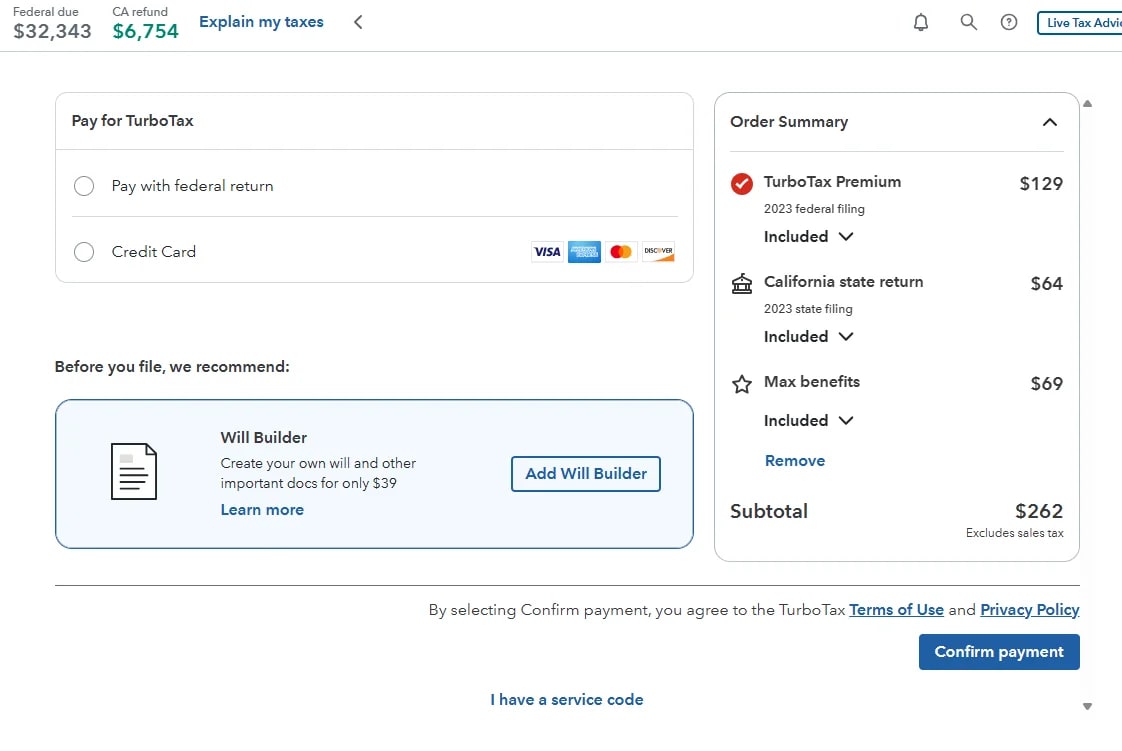

- Avoid the Refund Processing Fee: When you get to the payment screen, TurboTax will offer to deduct its fees from your refund for a $40 "refund processing fee." Skip this convenience trap and pay upfront with a credit or debit card to save the extra cash.

- Understand Service Codes: You might see mentions of "service codes." These are not public promo codes. They are unique, single-use codes given out by customer support to fix a specific technical or billing problem. Don't waste your time searching for them online.

While TurboTax may not have a traditional coupon strategy, there are clearly plenty of avenues for smart shoppers to save. By checking with your bank or employer, verifying your professional status, or simply filing at the right time, you can easily cut down your costs. And of course, DealNews will be tracking all the best links and offers as they go live.

What Does TurboTax Cost Before Discounts Applied?

TurboTax positions itself as a premium, user-friendly service, and its pricing reflects that. While it's generally more expensive than budget-friendly competitors like TaxSlayer or FreeTaxUSA, users are paying for a polished, highly-guided experience that minimizes confusion.

The cost structure is tiered, designed to match the price to the complexity of a user's tax situation. For 2026, you can expect prices to start at $0 for the Free Edition, move to around $79 for the popular Deluxe version, and top out at about $129 for the Premium tier, which covers self-employment and investment income.

|

Plan |

Typical Price |

Best For |

Key Features |

|---|---|---|---|

|

DIY |

$0 |

Simple tax returns for the standard deduction |

Covers Form 1040, W-2 income, and limited credits |

|

Live Assisted |

From $79 |

Homeowners and people who want to itemize |

Everything in Free, plus itemized deductions |

|

Live Full Service |

From $129 |

Investments, rental properties, self-employment |

Everything in Deluxe, plus investment reporting |

Note: Prices are based on typical list prices and are subject to change. State filing costs an additional fee for paid products. The best way to save on these prices is to file early and use a partner or special group discount.

This pricing strategy allows TurboTax to cater to a broad audience, from students with simple W-2s to freelancers with complex business expenses. Keep in mind that state filing typically costs an extra $59-$64 per state for paid packages. The key to getting the best value is to avoid paying for a higher tier than you actually need and to take advantage of the numerous partner and early-bird discounts that can significantly reduce these list prices.

How to Redeem a TurboTax Discount Code

Because most TurboTax discounts are applied automatically through special links, the process is usually effortless. However, if you do have a rare promotional code or a unique service code from customer support, applying it is simple. The most important step is to wait until you reach the final payment screen before trying to enter it.

- First, log in to your TurboTax account and complete your tax return. Once you're finished entering all your information, proceed to the "File" section.

- Follow the prompts until you land on the "Review your order" page. This is where you'll see a summary of your filing fees.

- At the bottom of the fee details, look for a link that says "I have a service code." Click the link and a box will appear. Carefully enter your code exactly as you received it.

- Click "Apply" and confirm that the discount has been correctly subtracted from your total before you finalize your payment.

That's all it takes. Just remember that the vast majority of savings come from clicking a partner link before you start, which requires no code entry at all. The manual entry step is primarily for those specific service codes issued by the support team.

Key Things to Know About TurboTax Discounts

If you've spent any time searching for a TurboTax coupon, you've probably noticed something strange: there aren't many traditional promo codes floating around. That's because TurboTax's savings strategy is built less around public coupon codes and more around partnerships, special programs, and automatic discounts.

Understanding how these different avenues work is the real key to unlocking the best price. To help you navigate their system like a pro, we've broken down all the essential details and answered the most common questions below.

How Do Discounts Actually Work?

Unlike many online stores, TurboTax doesn't rely on a constant stream of public coupon codes. The primary way to save is through partnership links. When you click a special link from your bank, credit union, or a site like DealNews, the discount is automatically tied to your session and applied at checkout. This means you often don't have to do anything other than start in the right place.

What's the Difference Between a Promo Code and a Service Code?

This is a key distinction. A "promo code" is a publicly available code for a general discount, which TurboTax rarely uses. A "service code" is a unique, 14-character, single-use code given directly by TurboTax customer support to solve a specific problem, like a billing error. You won't find legitimate service codes on coupon websites.

When Is the Best Time to Save on TurboTax?

Timing is everything. The absolute best time to get a discount on TurboTax is during the early filing season, typically from January through the end of February. During this period, TurboTax often runs its biggest promotions, with savings up to 25% off. As the April tax deadline approaches, these discounts tend to disappear and prices can increase.

Can I Really File My Taxes for Free with TurboTax?

Yes, absolutely—if you qualify. The TurboTax Free Edition is for simple tax returns only, which generally means filing a Form 1040 with W-2 income, taking the standard deduction, and claiming limited credits. According to TurboTax, about 37% of taxpayers are eligible to file both their federal and state returns for $0.

Does TurboTax Offer a Military Discount?

Yes, and it's one of the best available. Active duty and reserve military personnel (enlisted E-1 through E-9) can file their federal and state taxes completely free using any of the TurboTax Online products, regardless of their tax situation's complexity.

Are There Discounts for Students or Teachers?

TurboTax offers special programs for both. While the primary benefit for students is the software's ability to find education-related tax credits worth over $1,000, students and teachers are also often eligible for a 20% discount on the software itself by verifying their status through ID.me.

How Does the Refer-a-Friend Program Work?

It's a win-win. If you have a friend who's new to TurboTax, you can send them your unique referral link. They'll get 20% off their federal tax product, and once they file, you'll receive a $25 gift card. You can earn up to $500 in gift cards per year this way.

Do Returning Customers Get Special Discounts?

While most of the splashy percentage-off deals are aimed at new users, returning customers can still save. The best way is to take advantage of "early-bird" pricing by filing in January or February. Long-time users are also more likely to receive targeted email offers for their loyalty.

How Do I Use a TurboTax Service Code for a Refund?

A TurboTax service code isn't something you use to get a refund; rather, it's sometimes issued as a form of compensation or to fix a billing problem. For example, if you experienced a significant technical issue and contacted support, they might provide you with a service code to cover the cost of your filing as an apology. You would then apply that code at checkout to zero out your fee, effectively serving as a refund or credit.

Can I Get a TurboTax Discount Code from Fidelity or As An AAA Member?

Yes, Fidelity is one of the financial institutions that has historically offered a discount on TurboTax products for its customers. To get the deal, you typically need to log in to your Fidelity account and find the members-only deals or tax information section. From there, you'll use a special link that automatically applies the savings to your TurboTax purchase.

AAA members can often save on tax prep as a perk of their membership. Like with other partner programs, you'll need to visit the official AAA website, log in, and navigate to their discounts and rewards section. Clicking the specific TurboTax link from the AAA portal is the key to activating the discount.

How Do TurboTax Discounts Stack Up with Competitors?

While TurboTax is a fantastic choice for millions of filers, it's always smart to see what else is out there. The tax prep world is competitive, and knowing the landscape ensures you're getting the best value for your specific situation. Whether your top priority is price, in-person support, or a specific feature, here's a quick rundown of how TurboTax stacks up against the other major players.

|

Software |

Price Range |

Best For |

Key Feature |

|---|---|---|---|

|

TurboTax |

$0 - $129+ |

Beginners wanting a guided experience |

The most polished and user-friendly interface |

|

H&R Block |

$0 - $125+ |

The option of in-person support |

A huge network of physical offices for expert help |

|

TaxAct |

$0 - $110+ |

Confident filers looking for a better price |

More affordable path to file, with optional expert help |

|

TaxSlayer |

$0 - $73+ |

Budget-conscious and self-employed filers |

Low-cost plans that support complex forms |

|

FreeTaxUSA |

$0 |

The ultimate budget-conscious filer |

Completely free federal filing for all tax situations |

For a deep dive into H&R Block tax software deals, you'll find their biggest advantage is a huge network of physical offices, offering peace of mind for those who might want in-person help. Their free online version also tends to cover slightly more tax situations than TurboTax's.

When looking at TaxAct tax preparation discounts, the main draw is its lower price point for a comparable set of features. It's a solid choice for confident filers who don't need the extensive hand-holding that TurboTax provides, offering a more straightforward path to filing for less money.

Exploring TaxSlayer tax filing savings reveals a strong competitor for budget-conscious users, especially freelancers and gig workers. Their paid plans are significantly cheaper than TurboTax's while still offering robust support for self-employment income on Schedule C.

Finally, comparing with FreeTaxUSA tax service coupons shows the ultimate budget option. Their model is simple: federal filing is always free, no matter how complex your return is, with a small flat fee for state filing. This makes them a go-to for filers who prioritize cost above all else.

Troubleshooting TurboTax Discounts and Coupons

It's one of the most frustrating moments for any deal seeker: you get to the final checkout screen only to find that the discount you were counting on hasn't been applied. Because TurboTax relies heavily on special links and automatic discounts, there are a few common hiccups that can get in the way of your savings.

Perhaps you clicked a partner link but the price still looks high, or maybe your fee suddenly increased halfway through the filing process. Don't worry—these issues are almost always easy to solve. Be sure to refer to their user agreements to learn more.

Why Isn't My TurboTax Discount Working?

The most common reason a discount isn't applying is that you didn't start the process through the correct partner link. If you simply go to the TurboTax website and try to apply a code at the end, it likely won't work. You must initiate your return by clicking through the specific offer link from your bank, AAA, or another partner. If you did and it's still not working, try clearing your browser's cookies and clicking the link again.

I Upgraded My Product, and Now My Price Is Different. What Happened?

TurboTax's software is designed to automatically upgrade you to a higher-priced tier if you enter information that isn't supported by your current version. For example, if you start with the Deluxe edition and then enter income from investments, it will prompt you to move to the Premium version. The software is very transparent about this, so be sure to watch for these notifications to understand why your price has changed.

How Do I Avoid the $40 Refund Processing Fee?

This one is simple but easy to miss. When you get to the final payment screen, TurboTax offers the option to pay your filing fees directly from your federal tax refund. While convenient, this service costs an extra $40. To avoid it, simply select the option to pay with a credit or debit card before you file.

Can I Downgrade to a Cheaper Version of TurboTax?

Yes, in most cases, you can. If you realize you've been upgraded to a version with features you don't need, you can typically find an option to "switch products" or "downgrade" in the left-hand navigation menu or under "Tax Tools." As long as you haven't paid or submitted your return, you can move to a lower-cost version, and your information will be saved.

How to Save the Most at TurboTax Headed Into 2026

Getting the best price on TurboTax isn't about finding one secret coupon; it's about using a smart, multi-step strategy. By combining the right timing with the right programs, you can guarantee you're not overpaying. Here is the ultimate checklist for maximizing your savings on tax preparation.

File for Free with TurboTax Free Edition

Before you even think about paying, check if you qualify for the Free Edition. Approximately 37% of taxpayers can file both their federal and state returns for $0. This option is designed for simple returns (Form 1040) and covers W-2 income, the standard deduction, and key credits like the Child Tax Credit and Earned Income Tax Credit. It's the biggest money-saver of all.

Take Advantage of Partner and Membership Programs

This is the most reliable way to get a discount on paid TurboTax products. Many companies offer up to 20% off as a perk for their customers. Log in to your online accounts for banks like Bank of America, credit unions like NFCU, or membership clubs like AAA to find their exclusive TurboTax links. Clicking through from their site is essential to lock in the savings.

Use Your Military, Student, or Professional Status

Don't leave money on the table if you belong to a specific group. Active duty and reserve military get to file completely free. Students, teachers, first responders, nurses, and government employees can also often get up to 20% off by verifying their status through a service like ID.me during the checkout process.

File Early to Get the Best Price

Patience doesn't pay when it comes to tax software. TurboTax consistently offers its best public promotions, with savings of up to 25%, to early-bird filers in January and February. If you wait until March or April, you'll almost certainly pay more as prices increase closer to the tax deadline.

Get a 20% Discount with the Referral Program

If you're a first-time TurboTax user, ask a friend who uses the service for their referral link. Clicking through it will automatically grant you a 20% discount on your federal filing product. As a bonus, your friend gets a $25 gift card, making it a win for everyone.

Pay Upfront and Skip the Extra Fees

This is a simple but crucial final step. At checkout, decline the option to pay your TurboTax fees with your tax refund. While convenient, it comes with a $40 processing fee. Choosing to pay with a credit or debit card instead is an easy way to save forty bucks.

What Discount Seekers Are Saying About TurboTax Promo Codes

Deal seekers who use TurboTax generally have a high success rate with discounts, as long as they understand how the system works. Online forums and review sites are filled with users successfully saving 10-25% by using links from their bank or a cashback site. The most common point of confusion—and frustration—stems from users looking for a traditional coupon code to enter at the end of the process, which rarely exists.

Are TurboTax Promo Codes Worth It?

Absolutely. While you might not be hunting for a "promo code" in the traditional sense, pursuing a TurboTax discount is definitely worth the effort. Taking a few minutes to check your bank's website or use a referral link can easily save you $20, $30, or even more on your tax preparation. Given TurboTax's position as a premium service, these savings make an already excellent product an even better value, giving you a top-tier, stress-free filing experience for a much more competitive price. It's the smart way to get the best of both worlds: industry-leading software without paying the full sticker price. Before making any purchase, however, we always recommend reviewing the official terms of use to ensure you're fully informed.

How We Find and Publish Tax Discounts and Coupons

Our team of expert deal curators scours every corner of the internet to find the very best TurboTax deals for you, our readers. We work tirelessly to verify every offer, track down the best partner links, and monitor seasonal price drops. We ensure our listings are always up-to-date and accurate, providing you with a reliable, one-stop resource for saving money on your taxes.

Why Trust DealNews For TurboTax Discounts?

DealNews has been helping savvy shoppers save money on just about everything for years, and when it comes to services like TurboTax, this year is no different. We deliver hundreds of verified deals every single day, covering everything from tech and clothing to travel and tax software. Our years of experience and commitment to our readers ensure that every deal we post is the best price you're likely to find.

Want to tap into that expertise directly? Consider signing up for the DealNews Select newsletter. We'll send a list of the handpicked hottest deals straight to your inbox every weekday. And if you're waiting for the perfect price on a specific TurboTax package, you can set a deal alert and get an instant notification the moment the price drops.

Sign In or Register